2024.08 - Too Quiet?

IMHO

The world sleeps as Bitcoin keeps creeping upward.

Bitcoin has passed all-time highs in fourteen countries. pic.twitter.com/GjKF56J8qr

— Balaji (@balajis) February 22, 2024

Some embattled economies have funny ideas about how to solve their Bitcoin exchange problem.

JUST IN: Nigeria considers shutting down #Bitcoin and crypto exchanges to stabilise it's currency, the Naira. pic.twitter.com/mA8C868zFK

— Bitcoin Archive (@BTC_Archive) February 21, 2024

"If your ship starts sinking you should immediately dump all the lifeboats" — Nigerian Leadership, maybe

Meanwhile, the stock market continues to rip to all-time highs. Reality be damned. When you're inside a bubble, it can be hard to tell whether an asset is "cheap" or "expensive" because these are relative terms. Cheap / expensive compared to WHAT?

There are a few long-standing metrics for the stock market which could come in handy.

The Buffet indicator —which compares the stock market with the GDP— suggests the market is, at present, not just expensive but the most expensive it's ever been.

The "Buffett indicator" - the ratio of the market value of the entire stock market to GDP, has historically averaged around 65%. The ratio peaked at 88.3 prior to the 1929 crash. At the peak of the https://t.co/nAXLu0n9Gb bubble the ratio was 136.9%. Currently the ratio is 185%.

— Chris Marcus (@ArcadiaEconomic) February 19, 2024

The Risk Premium indicator —which looks at the reward of taking on risk with stocks vs the "risk-free Bond market— also suggests the market is not paying you enough for risk.

U.S. equity risk premium has fallen to its lowest level since the aftermath of the Dot Com Bubble.

— Barchart (@Barchart) February 22, 2024

This is the premium that investors receive to compensate them for taking on additional risk in the stock market instead of treasuries. pic.twitter.com/WDIcYSEdb9

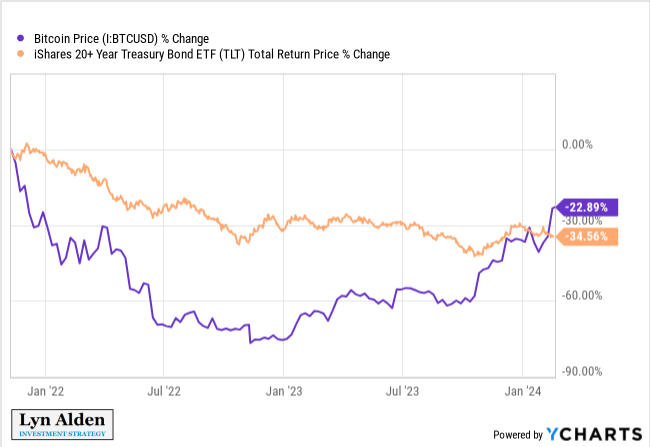

Of course, bonds have been far from risk-free lately, even when compared to the worst-timed Bitcoin purchase of all time.

One would think that when several indicators point in the same direction it may be worth it to pay attention. But the problem with raging bull market bubbles is dealing with soul-crushing FOMO when sitting in the sidelines as the names you like continue to rip. And if you bought the right 10 stocks in 2002 / 2003 you are sitting very pretty indeed.

While large stocks are partying like it's a new bull market, small stocks are getting crushed.

— The Kobeissi Letter (@KobeissiLetter) February 25, 2024

The Russell 2000, an index tracking small cap stocks, is down a massive 27% from its recent peak.

Meanwhile, the S&P 500 is officially up over 120% since its 2020 low.

Small… pic.twitter.com/wnBbkCtU5I

It would be suicidal to try and time the me market however, the froth will continue until it stops, there's no telling how high it may go. Always remember:

Markets can remain irrational longer than you can stay solvent.

In the meantime, Bitcoin critics are really struggling to come up with good material.

Gary thinks there are no Valuation models for Bitcoin (which is incorrect) and proceeds to say Gold is valuable because it can be used in jewelry and electronics (sigh).

#btc bulls never talk about #btc valuation, only price. I keep asking for a #btc valuation model but none exist. The discussion is all about #btc halving and hype and I can’t put a multiple on halving or hype. https://t.co/gHqtmeurLh

— Gary Black (@garyblack00) February 25, 2024

Fiancelot wonders what would happen if computers suddenly became bad at basic math.

What happens if the Bitcoin halving in April screws up?

— Financelot (@FinanceLancelot) February 26, 2024

And Andrew Sorkin —despite having been reporting on Bitcoin for years now— still thinks a store of value would be a stablecoin.

“If it was a store of value, it would stay one price.” -Andrew Sorkin

— Luke Mikic⚡️🇸🇻🇦🇺 9-5 Escape Artist (@LukeMikic21) February 21, 2024

Imagine the level of salt we’re going to see when the bull run begins.😂🧂

pic.twitter.com/pP3GYo9frs

They're not sending their best, I hope you're making the most of this opportunity.

Bitcoin News

Backing Down

It seems the Energy Administration is backing down from its plan to heavily survey miners. Congratulations to everyone that fought this.

🚨BREAKING: the @EIAgov @OMBPress will NOT enforce the "emergency survey" on #Bitcoin miners - pending further proceedings.

— Texas Blockchain Council (@TXblockchain_) February 23, 2024

We’re thankful to the court and Judge Alan Albright for their support of American innovation and freedom.

Thanks to @riotplatforms for being co-plaintiffs… https://t.co/IlBbcfTH9c

1%

Microstrategy keeps staking relentlessly. 17,000 BTC to go and they'll own a full 1% of the supply

One step closer to 1% https://t.co/X8ob1db21H

— 🧡NEEDcreations is stacking sats & jamming to EDM (@NEEDcreations) February 26, 2024

Other companies are stacking, some are relative newcomers. It will be interesting to learn which (if any) corporations have been buying the ETF —we assume this will be disclosed next quarter.

REDDIT SAYS THEY INVESTED EXCESS CASH INTO BTC AND ETH, MAY CONTINUE TO DO SO IN FUTURE

— db (@tier10k) February 22, 2024

Source: DB | Coins: BTC, ETH

While the ETFs may be outpacing Microstrategy in the accumulation game, one should not sneeze at the Gigachad's lead when it comes to corporate stacking. Will any one corporation ever catch up?

Kinda crazy that 9 out of 12 of the top corporate holders of #bitcoin are US based...these 6102 honeypots are coming along nicely. pic.twitter.com/guDhTRvWlD

— Wicked (@w_s_bitcoin) February 26, 2024

Fees Down

BTC fees rise and fall with demand for blockspace. It's that simple.

Another “bitcoin is broken, the fees are too high for people to use it” fud attack is over.

— hodlonaut 80 IQ 13%er 🌮⚡🔑 🐝 (@hodlonaut) February 25, 2024

Cue the “bitcoin is broken, the fees are too low for future security budget” fud attack.

🤷♂️ pic.twitter.com/QBHeFCIP5y

Krypto News

"Crypto" can be lethal to your portfolio

Frens

Seems SBF is making new friends. Maybe they'll talk him into some pushups.

GANG SHIT pic.twitter.com/nPxEyDcjD0

— tk (@tomkysar) February 20, 2024

Fiat News

Tails

A recent 20Y bond auction had the biggest-ever tail (demand was lower than anticipated). If this becomes a trend it will spell serious trouble considering the massive amounts of debt the US Government intends to issue.

Yields Surge After Terrible 20Y Auction With Biggest Tail On Record https://t.co/AuUfUcu59n

— zerohedge (@zerohedge) February 21, 2024

Indentured

US Household debt is at record levels with an eye-watering average of $400,000 per household.

NY Fed warns of mass defaults as household debt hits a record $17.5 trillion.

— Peter St Onge, Ph.D. (@profstonge) February 21, 2024

That's up $3.4 trillion since the pandemic -- almost $30,000 per household. On top of $10 trillion in new federal debt -- almost $80,000 per household.

In all the average American household is now… pic.twitter.com/uu5zqdaiV6

Consequently, interest payments are also at All-Time Highs. I find the steepness of the climb to be particularly worrisome.

Personal interest payments have now crossed $550 billion

— Game of Trades (@GameofTrades_) February 18, 2024

As consumers have amassed a lot of debt

Current levels have NEVER been seen since 1959

This is going to be very troubling for the already weak consumer pic.twitter.com/CTjtfkXzEZ

Jamie's First Dump

For the first time in his 18 year tenure, Jamie Dimon sold some of his JPM stocks. I wonder what he's buying, my bet is on Solana :-D

JP Morgan Insider Trading Alert 🚨

— Barchart (@Barchart) February 23, 2024

Chairman & CEO Jamie Dimon dumped 125 million worth of $JPM shares yesterday. He has been CEO since 2006 and this is his first ever sale of company shares. pic.twitter.com/eSurHMesaH

CRE

No relief in sight for US Commercial Real Estate, which means stress for small banks.

A historic building in Minneapolis just sold at a shocking 80%+ 'discount' - this is not a typo

— Triple Net Investor (@TripleNetInvest) February 25, 2024

The 164k sq ft building sold for $3.8 million or $23 per sq ft

What did the seller pay for it back in 2017? $19.2 million

What's concerning is that even at 70-80% 'discounts'… pic.twitter.com/hyzYAINEbo

Dystopian News

Nine

There's a sobering quote by Alfred Henry Lewis in the tweet below. Perhaps you could argue the number, but the concerning point remains.

“There are only nine meals between mankind and anarchy.”

— Josh, Mountain Respector (@StrangerJosh11) February 21, 2024

Alfred Henry Lewis pic.twitter.com/7C1lpf41TQ

PANIC

Will Chocolate become the new Bitcoin? Better stash away some Hershey's.

🍫🍫THE CHOCOLATE CRISIS — a thread:

— Javier Blas (@JavierBlas) February 19, 2024

Chocolate prices are about to rise — and bars and boxes will shrink too — after wholesale cocoa prices jumped beyond their 46-year old peak, setting a record high.

FREE-TO-READ (next 7 days): https://t.co/R4lHcFPKC7

1/ 10 @Opinion pic.twitter.com/PgRNzm9zIU

No Free Pass

No matter who the leader of a country is, dissidents dying in custody is a horrible and concerning development.

El Salvador Ex-Security Adviser Who Accused Ruling Party of Corruption Dies in Custodyhttps://t.co/ltz0uv59AB

— no bullshit bitcoin (@nobsbitcoin) February 19, 2024

Stay Warm

It was recently announced the infamous Lord Jacob Rothschild, has died at 87. (apparently he passed one week ago). Unsurprisingly, Twitter is having a field day with the death one of the elders of what many consider an extraordinarily sinister banking family, named in more conspiracies than you can shake a stick at.

BREAKING: Lord Jacob Rothschild, financier and member of the banking family, dies at 87 pic.twitter.com/qvreVWCRHi

— TaraBull (@TaraBull808) February 26, 2024

Go Woke

Google's AI Gemini gifted the world an absolute masterclass of how not to train an AI last week.

⚠️ JUST IN:

— Investing.com (@Investingcom) February 22, 2024

*GOOGLE APOLOGIZES AFTER NEW GEMINI AI REFUSES TO SHOW PICTURES, ACHIEVEMENTS OF WHITE PEOPLE$GOOGL pic.twitter.com/vWqH9Ya25A

And make no mistake, these over-the-top results were exactly what they wanted to achieve directionally.

I know it’s hard to believe, but Big Tech AI generates the output it does because it is precisely executing the specific ideological, radical, biased agenda of its creators. The apparently bizarre output is 100% intended. It is working as designed.

— Marc Andreessen 🇺🇸 (@pmarca) February 26, 2024

In overplaying their hand they made their (already obvious) agenda transparent, a big concern is that they will be increasingly more devious going forward.

Gemini Basic is woke GPT 3.5: it’s too weak to linguistically manipulate people successfully, but strong enough to clearly reveal the deranged values RLHFed into it.

— gfodor.id (@gfodor) February 26, 2024

The scary thought is a more advanced model may appear less biased simply because it’s a *better propagandist*

Why would Google want this?

We'd need to ask the CIA who has been filling a disproportionate number of leadership roles at Google.

2. Why would Google specifically choose these six senior executives to attend an @ISF_OSAC event in DC?

— Name Redacted (@NameRedacted247) February 25, 2024

Everyone in this picture, alongside former CIA Director Robert Gates, is a current senior executive at Google & a former career CIA officer, except for the attorney from… pic.twitter.com/xV9hh8vSEk

Speechless

Aaron Bushnell, an active-duty(?) member of the US Air Force self-immolated in front of the Israeli Embassy in Washington, protesting the situation in Gaza, he said: “I will no longer be complicit in genocide”. As some people rushed to extinguish his flames, the footage clearly shows a guard from the Israeli embassy training an unwavering gun at Bushnell.

HORRIBLE: A protestor (claimed to be an active duty member of the US Air Force) committed an act of self-immolation (burning himself alive) in front of the Israeli embassy in Washington DC today. He shouted:

— Brian Krassenstein (@krassenstein) February 25, 2024

“I am about to engage in an extreme act of protest, but compared to… pic.twitter.com/e7YTqatTrE

Price News

Bitcoin Surfing

Bitcoin managed to remain aloft near the $52k level last week and is starting the last week of February with a new gust upwards. The Board ($46.7k) is climbing up to provide some support.

Dip Fishing

After hanging around the $52k mark (prob. need to add a new support line, huh?), Bitcoin jumped straight past $53k today.

Calm Chart

February on schedule to close proudly green. Will march set a new, historic record for 7 Green candles in a row?