Last call to board before Big Money

The Bitcoin ETFs' performance has been nothing short of spectacular (by any standard).

Great stats, never ceases to amaze. I'll go one further: in the last four years 1,800 ETFs have launched and $IBIT is the most successful of all of them at $26b. https://t.co/8Nq6YwXhYj

— Eric Balchunas (@EricBalchunas) October 24, 2024

Interestingly though, this has mostly been driven by retail, not institutions. Not to say there is zero institutional interest, but there's no strong interest yet.

CNBC: BlackRock reports that 80% of the buyers of their Bitcoin ETF are direct investors, with 75% being first-time ETF buyers.

— meanwhile (@meanwhilelife) October 22, 2024

These young investors are moving from platforms like Coinbase to traditional managers to store their wealth. pic.twitter.com/EBeJYIcudg

Emory University just became the first university to publicly announce a Bitcoin position —we're that early— and $15M is a pittance when sized against many universities' trusts.

JUST IN: Emory University disclosed in SEC filings that it owns over $15 million in Grayscale’s mini Bitcoin ETF, making it the first university to invest in BTC 👀 pic.twitter.com/lmqowxbybw

— Bitcoin News (@BitcoinNewsCom) October 25, 2024

But there are stirrings in the world of Big Money. Microsoft is asking its shareholders to vote on whether or not to add BTC to their Balance Sheet (board recommended no).

This is a pretty huge deal, even if they decide to pass (which I believe they will).

Microsoft To Vote On Adding Bitcoin To Its Balance Sheet

— Joe Consorti ⚡️ (@JoeConsorti) October 25, 2024

Cliff-Notes:

• The National Center for Public Policy Research proposed that Microsoft evaluate bitcoin as an inflation hedge to protect its assets, given U.S. inflation and risks in traditional bonds.

• Bitcoin's… pic.twitter.com/Ei2c2znPe8

When the world's largest Megacorps start to publicly consider stacking BTC it shifts the Overton Window —the range of topics that are permissible to discuss without fear of ridicule.

2/ Overton argued that politicians are not leaders but followers

— Jash Dholani (@oldbooksguy) October 27, 2024

Since they want to get re-elected, they'll only turn those proposals into policy which already have some public appeal

A totally unpopular idea? Political suicide. Outside the "window of political possibilities"

It's not out of the question the decision may have some support from Microsoft higher-ups…

Microsoft CTO Kevin Scott on bitcoin: pic.twitter.com/1YBDAvzBSm

— Daniel Sempere Pico (@BTCGandalf) October 25, 2024

and the proposal shows they're very much aware of what's happened with Microstrategy

MicroStrategy is the greatest comeback story of the century. pic.twitter.com/8VGfMsYWct

— The ₿itcoin Therapist (@TheBTCTherapist) October 27, 2024

A decisive factor may rest on the elephant in the room becoming less invisible than it used to be. I'm talking of course, of the US public debt which is huge and unlikely to shrink soon, regardless of who's president.

Yes, the US public debt situation will get much worse next year--and the year after-- regardless of who will be President, and regardless of the balance of power in Congress. This challenge will block approval of any bold new legislation. https://t.co/KZPpqoCspQ

— Harald Malmgren (@Halsrethink) October 28, 2024

There is growing public acknowledgement of the ruinous trajectory of the US debt.

🚨 A man with a HIGHER RETURN RATE than Warren Buffett over the last 3 decades... has just gone short treasury bonds with 20% of his portfolio.

— Make Gold Great Again (@MakeGoldGreat) October 21, 2024

Probably nothing 🤷♂️ #Gold #SilverSqueeze pic.twitter.com/8mgYriNVeE

But the novelty is the growing recognition of Bitcoin's protective role in this environment.

From TradFi billionaires…

PAUL TUDOR JONES: “All roads lead to inflation. I’m long gold. I’m long Bitcoin. I own zero fixed income. The playbook to get out of this [debt problem] is that you inflate your way out.”

— Sam Callahan (@samcallah) October 22, 2024

To tech-bro billionaires who have in the past made fun of BTC as they pushed crypto pump-and-dumps…

🔶CHAMATH: "#Bitcoin will be the resounding inflation-hedge asset for the next 50-100 years."

— Radar🚨 (@RadarHits) October 26, 2024

"We're seeing the last vestiges of people using gold as a rational economic insurance policy, but the future is specifically Bitcoin." pic.twitter.com/XtGbPMtGIz

And even from stodgy Swiss bankers…

I’m sitting here, it’s 2024, this is Charles-Henry Monchau, CIO for a Swiss bank.

— Willy Woo (@woonomic) October 24, 2024

He’s explaining #Bitcoin to clients, and why it may be the next global reserve currency.

BTC is now at a tipping point to mainstream. pic.twitter.com/hoEjPGG1ak

Because while the stock market has been on an absolute tear,

Best year of the century for the S&P 500 pic.twitter.com/muNIESYXpu

— Andrew Sarna (@SarnaCapital) October 22, 2024

Several of the warning lights in the "Market's dashboard" are blinking red.

The Warren Buffet indicator —his prefered method to determine whether stock valuations were comparatively “cheap or expensive"— uses a Market Cap to GDP comparison and is currently saying stocks are more overvalued than ever.

JUST IN 🚨: Warren Buffett Indicator hits 200% for the first time in history, surpassing the Dot Com Bubble and the Global Financial Crisis pic.twitter.com/w0NV4RaMw7

— Barchart (@Barchart) October 22, 2024

And the Sahm Rule —a unemployment based indicator which identifies the onset of a recession— is now suggesting a recession is almost certain, will this be its first false positive?

The Sahm Rule has been triggered

— Bravos Research (@bravosresearch) October 23, 2024

It's predicted the last 9 recessions

With 0 false signals since 1960

This won’t end well

A thread 🧵 pic.twitter.com/v6Z81KWDL6

Even Central Bankers are acknowledging you can't borrow your way out of a debt problem.

Augustin Carstens, the central banker who oversees all the world's central banks, warns with CB soft words that if the individual central banks cannot get a grip on surging debt, economic growth will falter, inflation explode, and financial markets will become tumultuous https://t.co/5rr7RkVHgB

— Harald Malmgren (@Halsrethink) October 22, 2024

And have been increasing their gold holdings aggressively.

BREAKING: Central banks now hold 12.1% of global gold reserves, the highest level since the 1990s.

— The Kobeissi Letter (@KobeissiLetter) October 26, 2024

This percentage has skyrocketed this year and has more than DOUBLED over the last decade.

China, India, Turkey, and Poland have been the largest contributors to global central… pic.twitter.com/waIpBSI55H

All of this leads to a greater likelihood of other Nation States (besides El Salvador) turning towards Bitcoin in some fashion —the US adopting a Bitcoin Strategic Reserve as hinted by Trump would only accelerate this.

FORBES: "It’s hard to imagine that some form of game theory won’t play out when one or two central banks come forward to say they’ve followed El Salvador’s lead in holding bitcoin as a reserve asset, especially if one of those countries is the United States," pic.twitter.com/JX47QdEGaq

— Bitcoin News (@BitcoinNewsCom) October 25, 2024

But it's far from the only catalyst at play, given that BRICS members continue to search for alternative payment rails not controlled by the US

VANECK: Three of the six new members of BRICS - 🇦🇪 UAE, 🇦🇷 Argentina and 🇪🇹 Ethiopia - are mining Bitcoin with government resources.

— Bitcoin News (@BitcoinNewsCom) October 28, 2024

Russia's Sovereign Wealth Fund is investing in Bitcoin mining throughout BRICS countries with the goal of settling global trade in Bitcoin. pic.twitter.com/Nu7Ws8JI2x

The bottom line is this: The Overton window for big money (private, corporate and sovereign) coming into Bitcoin is already shifting. And the pieces are in place for a big announcement to suddenly jerk Bitcoin allocation straight from the current "Acceptable" position to "Policy". If/when that happens I'd expect a sizeable chunk of Big Money will start to play catch-up and we will be off to the races.

I don't own enough Bitcoin and neither do you.

Bitcoin News

Satoshi

A new Satoshi sculpture was just unveiled in Lugano, Switzerland. I think it's beautiful, clever and I applaud celebrating Satoshi's contribution to humanity.

I like it pic.twitter.com/wZqmQ3RIQY

— FRANCIS - BULLBITCOIN.COM (@francispouliot_) October 25, 2024

Solo

Solo miners has been making noise lately

NEW: A solo Bitcoin miner has mined block 867,118, thus garnering a block reward of 3.329 BTC, worth $221,690 currently. pic.twitter.com/hPxqGEvaGf

— Bitcoin News (@BitcoinNewsCom) October 26, 2024

But this one was particularly interesting. Most solo miners band together in a pool with "winner takes it all" rules, because this helps increase their individual odds.

But this guy was raw-dog mining with no pool and using DATUM (a new protocol which allows you to choose your own block template), so this seems to be the first "artisanally mined" block since the days of Satoshi. Kudos to the lucky winner!

Holy shit today is an historic day for Bitcoin…it happened the first independent solo block mined by a single user using their own hardware and software for the first time since the gpu days!

— John S (@JStefanop1) October 28, 2024

I can’t think right now but more to come in later today!https://t.co/WN1k7nj9Ee

Krypto News

"Crypto" can be lethal to your portfolio

Sinple

Crypto really is this simple.

Altcoins? Ethereum?@Excellion just wants to make sure @JoanaCotar and the German MPs don't waste their precious time. Back to Bitcoin! 🇩🇪 pic.twitter.com/XvDXAbCeLh

— JAN3 (@JAN3com) October 27, 2024

Here's a different version for the numerically inclined

Bitcoin 2021: $67,000

— Matteo Pellegrini ⚡️ (@matteopelleg) October 26, 2024

Litecoin 2021: $390

Ethereum 2021: $4,600

Cardano 2021: $2.90

Bitcoin 2024: $67,000

Litecoin 2024: $69

Ethereum 2021: $2,600

Cardano 2021: 32 cents

Any questions?

Private Blockchains

There's a special category of blockchains which are not open to anyone who wants to join. Much like the "intranets" of the early internet days, they may sound good on paper but don't really work. One of the big outfits pushing these is being taken out to pasture.

Private blockchains never made sense. This was always obvious. Yet it took a full decade for this obnoxious company to finally die.

— Dan McArdle (@robustus) October 25, 2024

R3 was staffed with folks who constantly disparaged Bitcoin, cozied up to regulators, & talked a lot about "blockchain not bitcoin"

Good riddance pic.twitter.com/DpBEYjLX9a

Fiat News

Yield

Yields going higher after a Fed rate cut suggests the market appetite for US debt is lacking.

I’m sure this is fine. Perfectly normal when the Fed cuts rates for inflation to spike and for yields to jump higher. https://t.co/TLOQDnWnvL

— Porter Stansberry (@porterstansb) October 22, 2024

The blue line in the chart below shows just how unusual the situation is.

The move in bond yields after the 50bp cut is very out of the ordinary pic.twitter.com/wWHa32rR3x

— Andreas Steno Larsen (@AndreasSteno) October 22, 2024

The normal relationships between rates and assets are out of kilter.

Current situation:

— The Kobeissi Letter (@KobeissiLetter) October 22, 2024

1. Bonds are falling like the Fed is raising rates again

2. Gold is rising like the Fed is aggressively cutting rates

3. Oil prices are falling like we are entering a recession

4. Stocks are rising like the bull market just started

5. Home prices are…

The Reverse Repo —think of it as the parking lot where banks "park" their excess liquidity is getting closer to the "fumes" level.

BREAKING: The Fed’s Reverse Repo (RRP) facility fell to $238 billion this week, the lowest since May 2021.

— The Kobeissi Letter (@KobeissiLetter) October 23, 2024

The RRP is key metric indicating the financial system's excess liquidity.

Large banks and other financial institutions, as well as money-market funds, park extra cash into… pic.twitter.com/VONN6K4iw7

And the numbers published by the government swing between horror and fiction

“In 2001, CBO projected a $5.6T cumulative surplus for fiscal 2002-11…

— Luke Gromen (@LukeGromen) October 28, 2024

…actual results were a cumulative deficit of $6.1T, a swing of $11.7T from the CBO’s January 2001 forecast.”

Moral: Projections of Trump or Harris budget impacts likely aren’t very useful…best case. pic.twitter.com/m8BMyxpEYi

All to say, if you're looking for signs…

Reporter: How concerned are you about the long term status of the dollar?

— Bitcoin News (@BitcoinNewsCom) October 27, 2024

::Treasury sign falls::

pic.twitter.com/D1sx4KpBEj

The signs don't point to health

BREAKING: A record $628 billion in US credit card debt is now unpaid or rolled over every month.

— The Kobeissi Letter (@KobeissiLetter) October 26, 2024

Over the last 3 years, revolving balances have jumped by $204 billion, or 52%.

This comes as the average interest rate on credit card debt spiked to a record 25% from 15% during… pic.twitter.com/B8iEfNShoy

Dystopian News

Bad Citizen

As technology continues to increase the power of the surveillance state, we must stay vigilant and reject handing over our freedoms in exchange for a doughnut, free burger or a beer. This things are not walked back easily.

Once you are blacklisted by social credit system, you can no longer do online shopping in China. Because all online shopping sites require a real name to login in, and you need to make payments with digital wallets Alipay and WeChat. pic.twitter.com/hIgQzyBMiv

— illuminatibot (@iluminatibot) October 27, 2024

Hopeful News

Chips

As you may know, most of the advanced chips powering everything are produced by one company. The Taiwanese juggernaut Taiwan Semiconductor (TSMC).

Their capabilities are ridiculously advanced and there is serious concern that China / Taiwan tensions could seriously hobble the global microchip supply.

This enormous risk may have finally found some mitigation as TSMC's new Arizona plant made a credible showing of its capabilities.

TSMC has achieved early production yields at its first plant in Arizona that surpass similar factories in Taiwan, a significant breakthrough for a US expansion project initially dogged by delays and worker strife https://t.co/9PcFIMAlSQ

— Bloomberg (@business) October 24, 2024

Redress

Long after many absurdities of the Covid response have been laid bare, some of the people directly affected by it are being compensated. Let's hope this becomes a growing trend.

Workers get $1 MILLION DOLLARS EACH for being fired over the ‘Covid Vaccine Mandate’🔥🔥🔥 pic.twitter.com/MhW5uPvbhV

— Liz Churchill (@liz_churchill10) October 24, 2024

On this note, Bill Gates faces criminal charges in the Netherlands for his role in the Covid vaccines. May he enjoy the fine Dutch prison food.

Bill Gates Must Face Vaccine-Injured in Netherlands Court

— Peter A. McCullough, MD, MPH® (@P_McCulloughMD) October 25, 2024

Netherlands judge rules that Bill Gates must face seven people injured by COVID-19 vaccines in court in the Netherlands. Albert Bourla, CEO of Pfizer, is another defendant, by John Leak @johnsearsleake… pic.twitter.com/XqyteJw6Ea

Price News

Higher

While I'm used to seeing BTC price in Log, I hadn't really seen in Log-Log (meaning both price and time are in log terms). There's no need to think to hard on this one, just enjoy the long-term trend

Once you see it in log/log, you can't unsee it. pic.twitter.com/sUcEF5NAb1

— ChartsBTC (@ChartsBtc) October 27, 2024

Speaking of trends, the tweet below makes a valid point that's worth considering as BTC bangs its head against the ATH.

As the price of housing suggests, CPI grossly understates the recent loss of purchasing power. $69k today is not the same as $69k in 2021.

Brilliant chart. Another reason I think we go much higher this cycle than people think.

— Bit Paine ⚡️ (@BitPaine) October 22, 2024

$250k in 2024 doesn’t feel like $250k in 2020, and CPI adjustments alone don’t cut it.

As the meme goes: bull market is Zillow time. For many, the big item they are saving up for is a real… https://t.co/xQIJGYgWi3 pic.twitter.com/MyqbGSUAFU

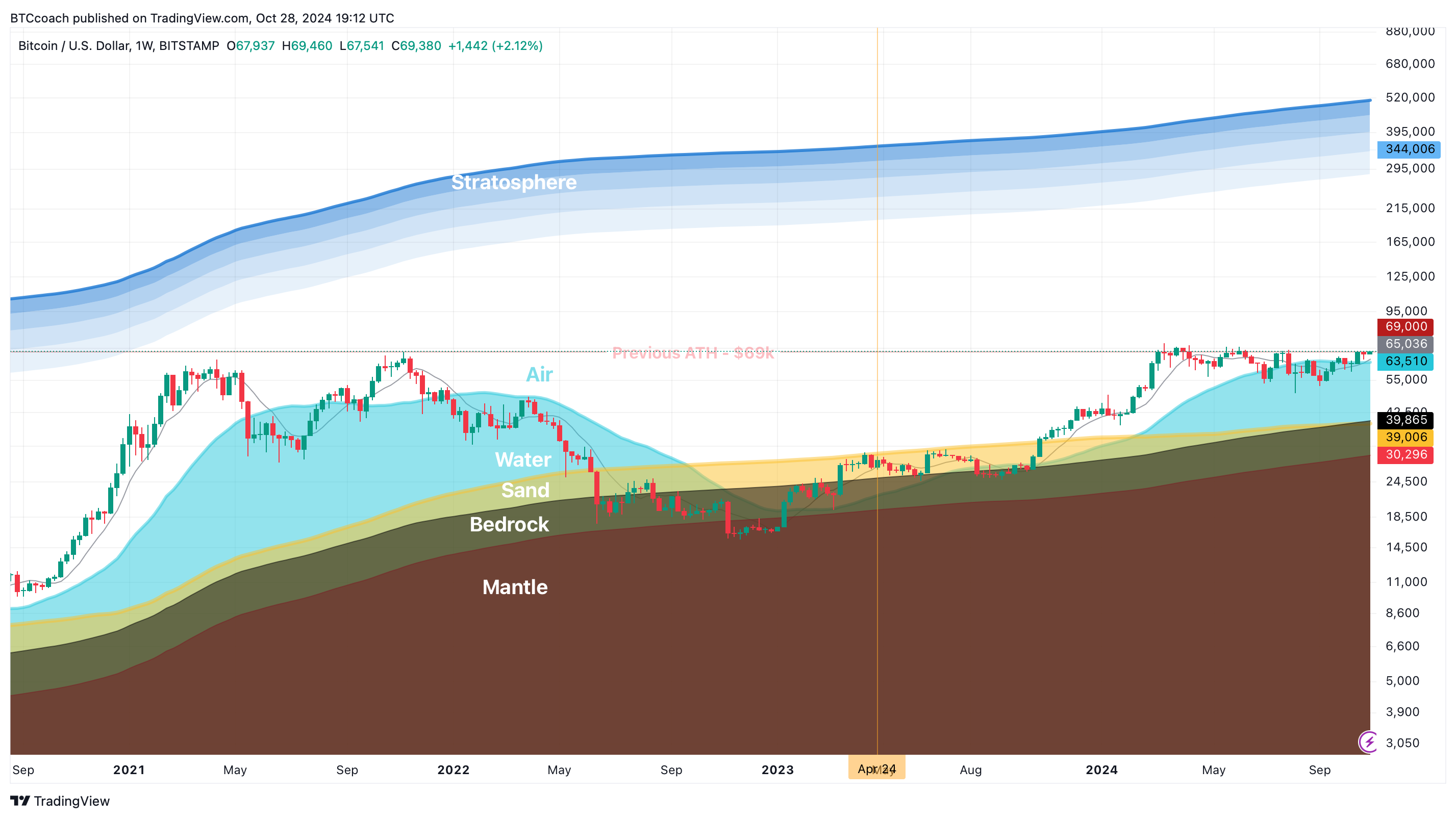

Bitcoin Surfing

After dangling its feet from the ATH last week, Bitcoin came back to the Board ($65k) briefly and jumped back to the ATH level, will it be able to hang on?

Dip Fishing

Last week I said a trip back to $65k would be unsurprising and $60k would be surprising but not alarming, hope you caught that dip.

Same range still in play this week, US election foreplay could make for wild action

Calm Chart

Uptober looks like it will live up to its name and close green.