Waiting for $40k

Last night I got this question from a finance-bro friend. He'd bought some BTC last cycle, sold at $40k for a handsome profit and looked like a genius for 2 years. Now he's pondering when to "get back in". He asked for my opinion on his plan:

Next time it drops to $40k I'll buy through the BTC ETF (I trust BlackRock custody more than I trust myself).

My quick answer was "No you won't. For the same reason you didn't buy back at $20k"

It's worth unpacking a few aspects of this plan:

Entry Point

Is it sensible to believe BTC could drop back to $40k?

Obviously no one can predict the future, but there's strong precedent for using moving averages to predict support lines: it's unlikely price will fall below the average price of Bitcoin over the past 4 years ("slow" average), but it's likely it could fall below its average price over the past 4 weeks ("fast" average).

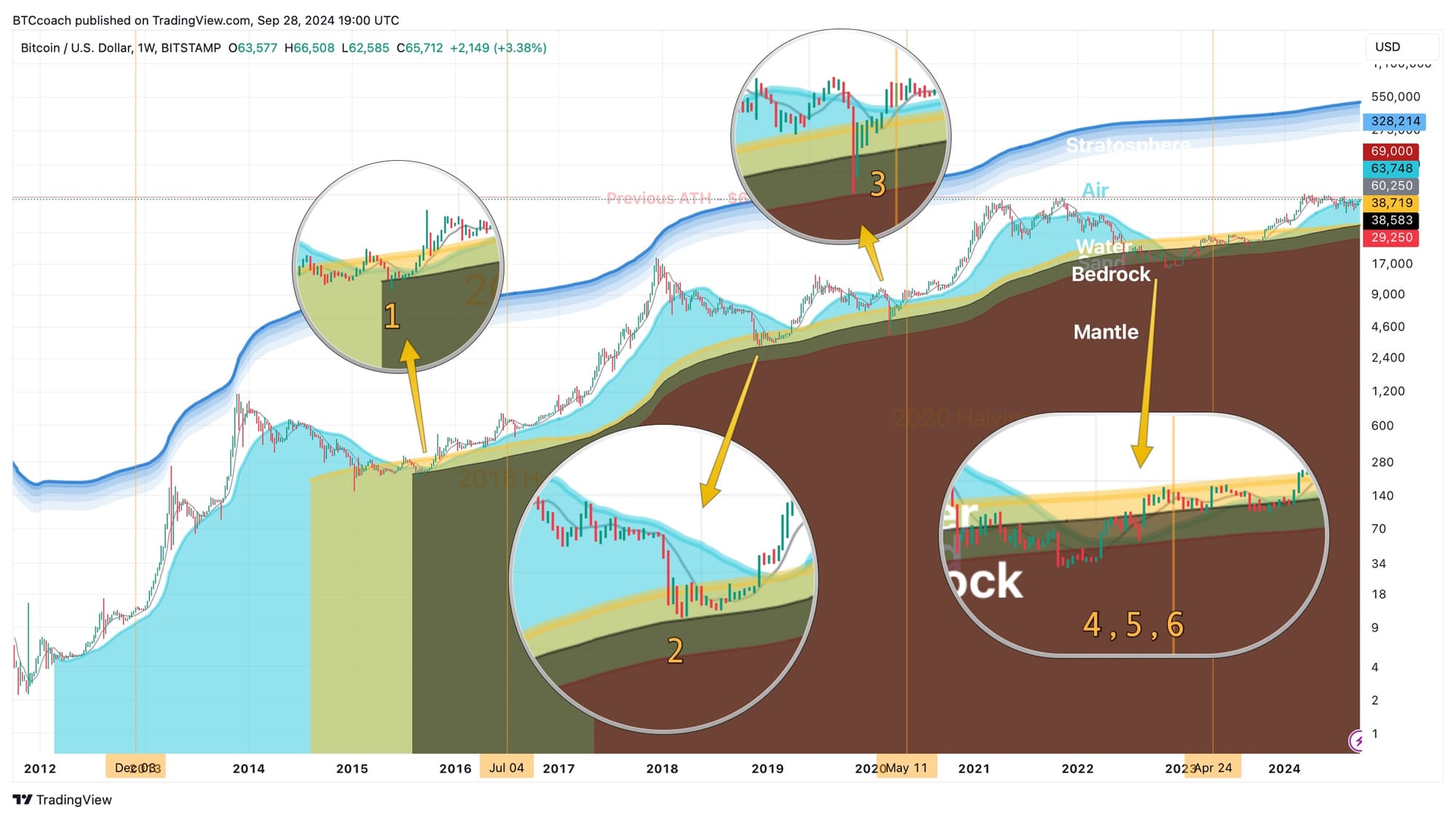

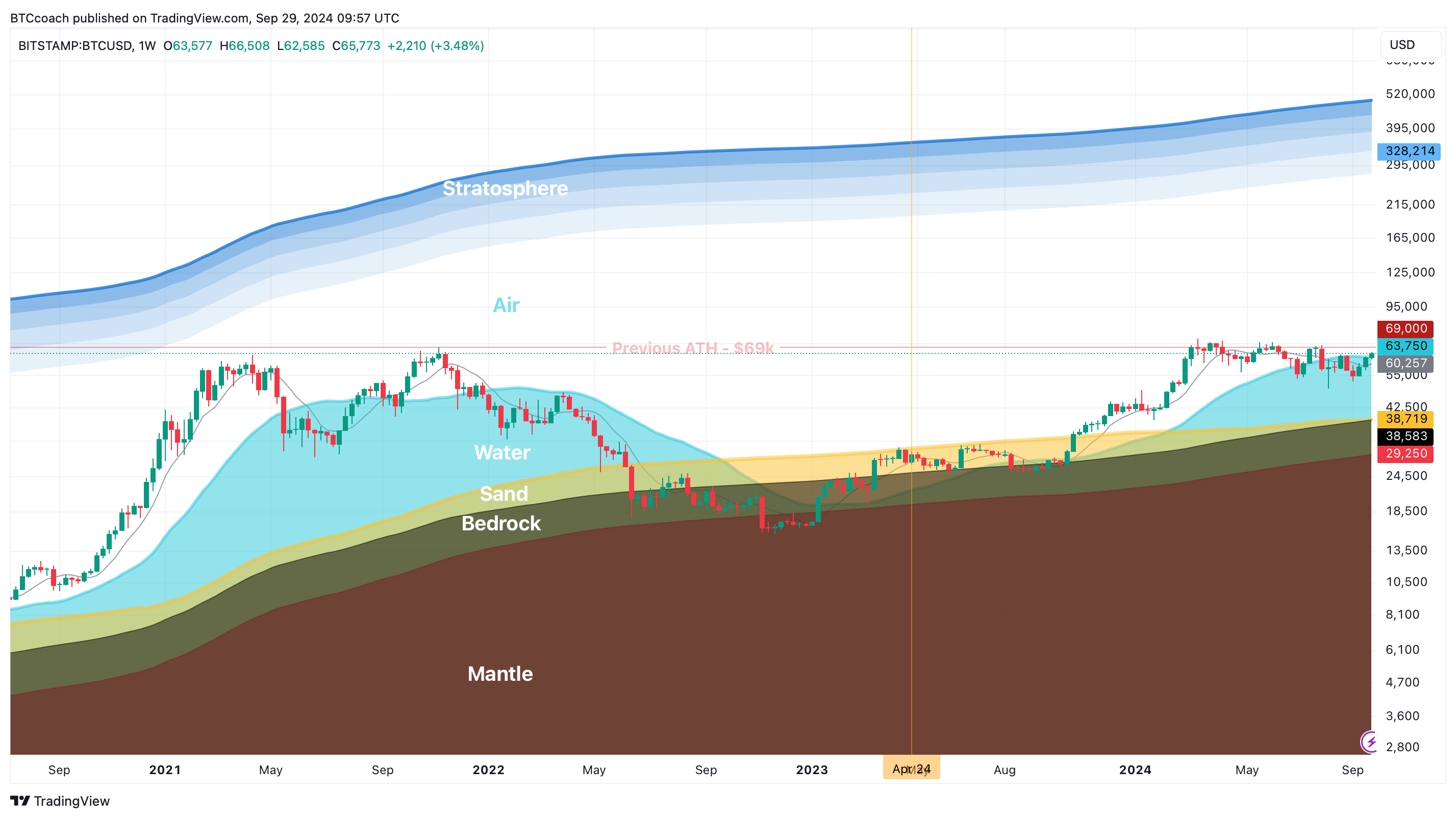

I use these kinds of average for my weekly "Bitcoin Surfing" chart in which I usually show only the past 4 years.

Below we're going to look at the chart through BTC's entire lifetime (you'll notice some lines take time to "appear". As a reminder, each candle in this chart represents 1 week and the lines/levels which I've colored and nicknamed metaphorically as Mantle, Bedrock, Sand, Water and The Board are simply moving averages (from slowest to fastest). The rule of thumb is: the "slower" the moving average, the stronger the "support".

A fall back to the $40k level would get close to current "Bedrock" levels ($38.5k). Hitting "Bedrock usually means one of two things: we're near the bottom of a bear market or some market catastrophe happened (FTX blowing up, etc.)

If we look at instances in the past where price has dropped low enough to touch "Bedrock" we see (instances 1, 2 and 3) it has usually been a sharp move down —marking the low for that year— followed by a quick bounce back up.

The current cycle ( instances 4, 5 and 6.) has been exceptional:

- It's been the first time price stayed below "Bedrock" longer than 2 weeks

- It's been the first time price went low enough to pierce the "Mantle" (and stayed there for 2 months)

- It's been the first time price broke out of Bedrock (twice) only to fall back below again.

My reading of this is that the lows for this cycle were plumbed and trawled rather exhaustively. There was plenty of opportunity for weak hands to capitulate below $20k, and we spent from early December to February hugging the $40k mark and push past once the ETFs came to life —the most aggressive down-wick we've seen since the ETFs only reached the $49.5k mark.

To me the above suggests we're not going to see $40k again. And if we do it'll be because something so horrible happened in the markets that the last thing on normal people's minds will be buying the dip. The proof is in the pudding: my friend had over 6 months to buy below $20k, he didn't.

Custody

The concept of self-custody is a huge psychological barrier for many people. It's understandable, we're trained to trust the system more than we trust ourselves.

I don't want to minimize the challenge of self custody —it's not just "write down 12 words"— it's figuring out how to store them safely and pass them on if you die / are incapacitated. But it's even harder to convey the importance of it. Buying Bitcoin and stopping it with a custodian is a bit like buying a gun but not buying bullets.

The solutions are increasingly better and more friendly, but they do require SOME effort on your part. You should become competent at self-custody before you make a decision to trust a custodian, incompetence due to laziness is not an acceptable reason to go with a custodian.

Always Expensive

Bitcoin is expensive at every price for newcomers. Most of the profit-taking newcomers miss this. They buy, sell at a nice profit during the bull run and think they'll buy back lower. Then they're proven right as the price crashes validating their decision. But they don't buy back lower because they never developed conviction in the asset. They only notice it again once the current price is higher than their exit.

The right move is to eat humble pie and buy back, but instead many wait for the return of some mystical entry-point.

Last Word

One of the biggest challenges in Bitcoin is this: "Don't outsmart yourself."

Bitcoin News

Decentralizing

As I've mentioned in previous weeks, one of the real, legitimate concerns in Bitcoin has been the centralization of mining. While the actual machines (we will call them hashers) that turn electricity into hashes in the competition to find new blocks are fairly well distributed, they currently have no input into the design off the blocks they are trying to find. To make matters worse, their efforts are channeled by pools which act in concerted fashion behind the scenes.

The end result is only a minuscule handful of pools are deciding the content of new blocks. Ocean Mining has been working to counter this (by offering their hashers different block templates to choose from) and have now released DATUM, software which allows hashers to choose their block templates directly. I know this is technical but it's a hugely important step forward in the constant fight against the natural gravity of centralization.

Introducing: 𝗗𝗔𝗧𝗨𝗠

— OCEAN (@ocean_mining) September 29, 2024

𝗗ecentralized

𝗔lternative

𝗧emplates for

𝗨niversal

𝗠ining

It’s happening. pic.twitter.com/HVi7URBfSm

One day after its release, the first block mined with DATUM was produced. This is excellent and hopeful news.

BREAKING: First DATUM block on @ocean_mining

— Mark Artymko (@MarkArtymko) September 30, 2024

Template constructed and block found by miner “Just For Krypto” 🔥🔥🔥 https://t.co/07DujqkLBV pic.twitter.com/pXuHyXkqsb

Regulators

Not all is rainbows, alas. Regulators are still trying to clamp down on self-custody through nonsensical law fare

There it is folks; every non-custodial wallet, node operator, & miner just became a Money Services Business. If you haven't joined the fight yet, the window of opportunity is closing quickly. Chip in now or be labeled a radicalized criminal tomorrow: https://t.co/vFHTUX9cVi https://t.co/9cyG2gAH2l

— burn the bridge (@econoalchemist) September 27, 2024

And the SEC continues to drag its feet allowing for banks to become BTC custodians —not that I'd recommend any individual to custody their BTC with a bank.

🚨BREAKING NEWS‼️

— The ₿itcoin Therapist (@TheBTCTherapist) September 24, 2024

42 members of Congress wrote SEC Chairman, Gary Gensler, a letter urging him to allow banks to more easily custody #Bitcoin.

Gensler has refused to comply with the request. pic.twitter.com/OT2gqKQeKP

As a reminder, it is laughable to claim concerns for criminal activity, which is rampant in the traditional financial system.

Really? Unwittingly?

— Freddie New (@freddienew) September 24, 2024

But @SenWarren reliably informed me that criminals preferred to use Bitcoin.

What are criminals doing using the highly regulated and compliant banking system? Didn't the KYC and AML regime work after all? pic.twitter.com/EooIynRqRc

Too Late?

It's common for newcomers to feel they're too late for Bitcoin.

If this is you, consider the two tweets below.

Had dinner tonight with the head of a $20 Billion Family Office. You would recognize the name. You've likely used their product.

— Flying Raven ⚡️🇺🇸 (@OffshoreHODL) September 25, 2024

They are completely focused on buying stabilized class B apartments, BTR, self-storage and residential development.

Zero interest in #Bitcoin. None.

"@MicroStrategy took a $500M company with $500M in capital growing at 0% a year and we turned it into a $500M company growing 5-10% a year with $6,000,000,000 of capital growing 160% a year—that’s the #Bitcoin strategy." - @saylor to @saifedean

— Stephen Chow (@chowcollection) September 28, 2024

Most people are still closed to the idea of Bitcoin —regardless of the numbers, stack hard before they wake up.

Fiat News

Canary

SBF's partner-in-crime Caroline impressed the judge with the extent of her cooperation and got a light, 2-year sentence along with an $11 BILLION fine for her role in the biggest financial fraud in US history.

BREAKING: Caroline Ellison of FTX, while charged guilty and sentenced to two years in jail, must also forfeit $11 billion USD (!!!!!)

— unusual_whales (@unusual_whales) September 24, 2024

Xi-mulus

China has opened the floodgates to stimulate its economy

⚠️ JUST IN:

— Investing.com (@Investingcom) September 24, 2024

*CHINA WILL ALLOW SECURITIES FIRMS, FUNDS AND INSURERS TO TAP PBOC FUNDS TO BUY STOCKS

*CHINA PLANS AT LEAST 500B YUAN OF LIQUIDITY SUPPORT TO STOCKS

🇨🇳🇨🇳 pic.twitter.com/RJC6wY9yT3

And the market is eating it up. This is good for Bitcoin.

JUST IN: 🇨🇳

— Radar🚨 (@RadarHits) September 27, 2024

China's stock market has gone PARABOLIC this week after the government announced $140B stimulus and multiple rate cuts.

This is the BIGGEST weekly gain since 2008. pic.twitter.com/xXPJtuJuvL

Now do Pelosi

Rules for thee but not for me seems to be the standard in Washington.

JUST IN: Representative Darrell Issa has just violated the STOCK Act.

— unusual_whales (@unusual_whales) September 26, 2024

He disclosed $175,000,000 (!!!!) of Treasury transactions late, by over 500 days.

His fine for breaking the law will be $200, if he is forced to pay it.

Most in Congress do not pay the fine.

Dystopian News

Port Strike

There's an imminent port worker strike —across 36 ports on the east coast (and gulf ports)— set to begin at midnight tonight. It is a huge deal (in 2023 they represented close to 26% of the value of all US imports).

Time Is Running Out: US Port Strike Could Begin Tuesday; Goldman Finds Highly Exposed Retailers | ZeroHedge https://t.co/kOyUvHbIlx

— PupPatriot (@PupPatriot2) September 30, 2024

Apparently this is below the line for the Commerce Secretary, who is focused on other things.

This is the same woman who didn’t know what the Bureau of Labor Statistics was when asked about jobs data last month. https://t.co/5BdWrN2gtF

— Marty Bent (@MartyBent) September 30, 2024

Muzzles

John Kerry joins the list of politicians who finds your freedom of speech problematic.

John Kerry calls for a Ministry of Truth:

— End Wokeness (@EndWokeness) September 29, 2024

"The 1st Amendment stands as a major roadblock for us right now" pic.twitter.com/1mtpjjxeM7

Price News

Bitcoin Surfing

Bitcoin tried to use the Board ($60.2k) as a springboard to get above the Water ($63.7k), we'll see how that goes.

Dip Fishing

After briefly punching through the $65k resistance, price is being knocked down hard towards the $62.5k support. $60k may still be in the cards and $56k is not out of the question, but contrary to my friend's opinion I don't think we'll see $40k again.

Calm Chart

This is by no means the first "green September" in Bitcoin's history but it is unusual and unexpected. Will we get "Uptober" despite the looming elections?