Is Bitcoin too good to be true?

Last week I asked my subscribers to send in their questions. The very first one to arrive caught my attention:

Do you also sometimes stop and think - is bitcoin too good to be true? Given the absolute magnitude of what it might become… —Johannes

Overhype

There's no lack of over-hyping Bitcoin. It even comes in flavors.

Moon-math is probably the most popular flavor.

I get that price predictions are fun and tempting, but some are just ridiculous. For example, people are still reposting this 2021 "prediction" from Fidelity —without mentioning the context of the piece (BTC may go to $1B but then a burger would probably cost $500).

Fidelity, with a whopping $4.9 trillion in assets, forecasts Bitcoin ($BTC) could hit $1 billion per coin by 2038. 😱🚀

— Havoc 🔥 (@Metaverse_Havoc) September 5, 2024

Over time you learn to take these predictions with a handful of salt, sometimes the huge, mesmerizing numbers come with cerebral explanations in an attempt to infuse gravitas into their claims, the Power Law being the latest in an illustrious line of "infallible" models.

4/n The Bitcoin Power Law Theory (PLT) explains Bitcoin's behavior scientifically. It describes the growth of Bitcoin adoption and on-chain parameters in a coherent, falsifiable way. #Bitcoin #Crypto

— BitcoinBottomTop (@btc_bottom_top) September 8, 2024

I'll admit I haven't done a deep dive on the power law (nor do I have plans to). While it sounds interesting and may be directionally correct, the only person I trust to use math and science to predict future human behavior is Hari Seldon.

There have been many predictive models for BTC's price, they've all been broken at some point, I expect the same will happen to the power law. If you try to use it to trade I expect you'll wind up regretting it.

Speaking of price predictions that are too good to be true —this goes double for those that have nearby dates attached to them:

You may doubt #Bitcoin will reach $1.0M within the next year, but you’ll see. pic.twitter.com/PcmOl2zUsg

— Samson Mow (@Excellion) June 23, 2024

Now, I like Samson and think he's a smart dude. I also agree with him directionally —it seems reasonable to me that BTC will be valued around $1M within a decade. But one year?? Nah. Even if we get a bull-run with a blow-off top (like we had in 2017) and BTC spikes to $1M for five minutes before "crashing" down to $200k, is that meaningful?

Spending two years near $200k while saying "we were at $1M for an instant" sounds as fun as the 2018-2020 bear market, not very.

Moving on to our next flavor: "hyperbitcoinization" —BTC will absorb the entirety of fiat and become the coin of the realm for the entire globe.

Uhhhh guys...

— Joe Burnett, MSBA (🔑)³ (@IIICapital) August 16, 2024

I just asked ChatGPT this and look at what it said back.

We're living through hyperbitcoinization. pic.twitter.com/lK9ylnFx9G

Another amusing thought-experiment, reminiscent of the 90's when Mac vs Windows seemed to be locked into a Highlander-like "there can be only one" scenario.

Turns out the world is pretty big and there's room for more than one apex-predator, I don't believe fiat has to die for Bitcoin to fulfill its purpose nor do I think it wise to with for the quick death of fiat —as Bitcoin is not ready to onboard billions of people and the death of fiat would probably involve horrible convulsions.

What matters to me is that the option of Bitcoin be available to anyone. The more this is true, the more we are winning. People will opt in at their own pace.

Our next flavor of overhype is…

The Supercycle — a scenario where Bitcoin enters something like a perpetual bull-run because everyone wakes up to Bitcoin and loses interest in shitcoins. Sigh.

Have we seen the final ''crypto'' bull market?

— Luke Mikic⚡️🇸🇻🇦🇺 9-5 Escape Artist (@LukeMikic21) February 27, 2024

📺These are the 5 bullish catalysts that suggest this upcoming Bitcoin bull market could be a supercycle.👇🏾 pic.twitter.com/f9inOaFlqH

Sorry, the super cycle is absolutely not going to happen (and shitcoins won't disappear overnight), even though it is now known it's a huge circle-jerk

> the yield comes from borrowers, trading fees, etc

— vitalik.eth (@VitalikButerin) August 25, 2024

Right, so this worries me. Because it feels like an ouroboros: the value of crypto tokens is that you can use them to earn yield which is paid for by... people trading crypto tokens.

Even if the answer is something clear like…

Human nature changes slowly, BTC is on its way to becoming less fringe but is still far from mainstream understanding / acceptance let alone adoption. Much of the media coverage is still unfavorable and biased.

one of the most prominent journalists covering Bitcoin today has written a critical article exposing how the @BBC has contributed to spreading misinformation about Bitcoin, supported by data

— Fernando Nikolić 🇦🇷 🟠 (@basedlayer) September 5, 2024

the publisher’s response?

they deleted the article.

so, I’m sharing the archived link… https://t.co/OxbTo0WPCn

To close this section, yes overhype in Bitcoin is absolutely real and if you buy into it these wild expectations you'll be disappointed.

Underhyping

Still, without waving our arms around too much, I believe it's fair to say the future looks bright for BTC and there's plenty to be hopeful about.

Global allocation to BTC is still minuscule and has a lot of room to grow.

2.1 quadrillion sats is just about the right number to store all human value forever. The fiat clown world has essentially pushed us to that number in dollar terms: $900T in global assets plus $1.2 quadrillion in derivatives.

— Samson Mow (@Excellion) August 14, 2024

Now we rebase everything to #Bitcoin and deflate. pic.twitter.com/QFWNnIkQg5

The ETFs have brought BTC out of the kiddie-pool in terms of liquidity. We are now in a lake that connects to the ocean, a few bigger sharks are now starting to sniff around…

Over the last five years, #Bitcoin has been an outsider to the tradfi community, and it’s only now dipping its toe into global finance. Cantor will help tradfi bring Bitcoin all the way in. Tradfi wants new asset classes, and $BTC is here to stay. pic.twitter.com/XdMMuw254p

— Howard Lutnick (@howardlutnick) September 3, 2024

but corporate adoption is only just getting started.

A huge underreported trend is happening in Bitcoin.

— River (@River) September 4, 2024

Everyone's looking at @saylor and MicroStrategy, but don't realize thousands of businesses are now buying bitcoin daily, including on River.

Some key insights from our new report on business adoption in this thread 👇 https://t.co/91kgxuFTmE pic.twitter.com/ng4izAvmSg

No one is likely to catch up to Microstrategy but their playbook becomes increasingly hard to ignore.

What cool moment.

— HODL (@americanhodl8) September 9, 2024

It feels weird to be proud of a billionaire, but in bitcoin terms I’m a “big bro” to Michael.

His Hodl journey has been very public and just as emotional and full of turmoil as the rest of us.

Michael was peers with bezos. He was one of the longest… pic.twitter.com/g4Cep1tJCV

And if Bitcoin fails to be the highest performing asset within a certain time period (and turns out to only be the second or third best-performing asset), I hope you'll still be able to forgive yourself.

NVIDIA vs BTC vs GLD

— Bitcoin News (@BitcoinNewsCom) September 8, 2024

pic.twitter.com/QC0aF0szSk

If you understand what it means to own BTC you'll be less fixated on price predictions and more focused on the peace of mind it gives you to own a something that preserves and grows your long-term purchasing power without the headaches of counterparty risk.

SAYLOR BREAKS DOWN BITCOIN’S SUPERIORITY IN 60 SECONDS 👇

— Walker⚡️ (@WalkerAmerica) September 9, 2024

“You buy #Bitcoin, you hold it for more than four years… Bitcoin’s an expression in this view that you want to invest in an asset without counterparty risk. Which means you don’t want to be counterparty to a country, a… pic.twitter.com/m5HPYWyNis

Nation-State adoption is still in its infancy and mostly quiet, but it has started.

Russia mined over $3 billion in Bitcoin last year, boosting tax revenue amid sanctions https://t.co/NNZfs3OHpb

— 1ontop (@1ontop2) September 8, 2024

And we don't need the whole "BRICS will adopt to BTC" hype either.

Yes, it would make sense but no, that doesn't seem to be happening. BRICS nations seem to be shoring up their gold-reserves to make themselves less vulnerable to the inherent and unavoidable counter-party risk in owning dollars

🚨BREAKING: Russia just significantly increased their DAILY gold purchases from $12m to $90m USD.

— Make Gold Great Again (@MakeGoldGreat) September 5, 2024

What a lead-up to the #BRICS 24th Oct summit 👀

India, Russia, Turkey all dramatically increasing their #gold and #silver purchases....Western media 🦗

Guests to leave with 40%… pic.twitter.com/XpZfEqZnqU

The future is already here, it's just not evenly distributed —William Gibson

Slowly but surely, the window of opinion is shifting.

JUST IN: 🇩🇪 German parliament member Joana Cotar said "it is very important" that more german parliament members understand #Bitcoin.

— Bitcoin Magazine (@BitcoinMagazine) September 6, 2024

Germany selling 50k #BTC "was something very, very upsetting." 👀 pic.twitter.com/QYeiLtajLQ

Finally, there are still real challenges ahead for Bitcoin, block-template centralization being one of them —the fact that very few "hands" get to control what gets put into a new block. I slightly disagree with Steve's posture (below) where he says BTC is a slave to Central Banks. I would say centralization increases the risk of that happening, but not that this is the current state of things.

Regarding mining centralization, the problem isn't the decentralization of hardware, hardware is well distributed.

— Steve Musthash Barbour (@SGBarbour) July 25, 2024

The problem is the centralization of block creation, which stems from the block withholding attack.

Until BW is solved, Bitcoin will be a slave to Central Banks.

Fortunately a new model, proposed by Ocean Mining is not only helping block formation decentralize, it's also generating more revenue for miners.

BREAKING: Bitcoin mining centralization.

— OCEAN (@ocean_mining) September 7, 2024

OCEAN reaches 56% of unique miners receiving newly generated coins.

Our latest block paid out 50 unique Bitcoin addresses from the coinbase, meaning 50 people received bitcoins directly from Bitcoin itself, not from a middle man.

Over… pic.twitter.com/SZKlqITecl

In closing, I think Bitcoin is not too good to be true, if you build up your understanding and ability to calibrate the "news" —which is full of outlandish claims. The prospects for Bitcoin are bright even if the most bullish scenarios don't come to pass.

Next week I'll be writing about another question I got:

"I was researching Bitcoin stuff on Chat GPT and it said it's just one of many applications of Blockchain. Do you still think everything "blockchain" is a scam, are you still as much of a maxi as always?

This question is timely for me as last week I met a some newcomers at a couple of live events, some of them got their start through a blockchain course which included BTC as well as various shitcoins.

Do you have a Bitcoin question you'd like me to answer? ask below:

PS. Johannes, I hope you found this answer helpful.

Fiat News

Cuts

As I mentioned 2 weeks ago, rate cuts (or the expectation of) have often been met with drops in the stock market, this time has not been the exception.

The stock market has not seen a single green day in September yet.

— The Kobeissi Letter (@KobeissiLetter) September 6, 2024

Including today's drop, the S&P 500 is now down 3.4% this month and it's only the first week.

That's $1.7 trillion of S&P 500 market cap erased so far.

Maybe rate cuts aren't what the market wants after all. pic.twitter.com/qWF8ZDbIFg

And one of the many indicators people lean on to try and predict a recession (the yield curve inversion) is now suggesting a recession is at hand.

This yield curve inversion is WORSE than 1929 and 2008

— Game of Trades (@GameofTrades_) September 5, 2024

Buckle up pic.twitter.com/u3GEu1woDQ

This is not hard to imagine as we've come out of a very rare zero-rate environment which distorted the markets. Walgreens is one example…

RIP Walgreens. $7B MCap, very little cash, $34B in debt. I'm sure many companies look like this under the hood—wrongly assumed debt would be cheap forever. pic.twitter.com/GxBf3JnWOa

— Tuur Demeester (@TuurDemeester) September 5, 2024

But far from the only one. Reality may take time to catch up with the markets, but it always does eventually.

Coca-Cola is in $50 billion of debt.

— Brett Pike (@ClassicLearner) August 26, 2024

Budweiser is in $78 billion of debt.

Target is in $12 billion of debt.

These corporations don’t push woke nonsense by accident. They are completely leveraged by firms like Blackrock.

Shout out to @va_shiva for coming up with the term… pic.twitter.com/LyYnCKt5ho

When you ratchet up the debt problems to federal government levels your eyes start to water.

That is crazy.

— Wall Street Silver (@WallStreetSilv) August 14, 2024

We are running a budget deficit of over $2 trillion per year.

Our debt is $35 trillion and growing.

Interest on the debt is running on pace for $1.5 trillion per year. pic.twitter.com/ivr8zfcf35

A reminder on just how large a Trillion is:

The magnitude of difference between 1 million and 1 billion is not that intuitive and can be illustrated with this example of the time scale:

— Massimo (@Rainmaker1973) September 6, 2024

- A million seconds is 12 days.

- A billion seconds is 31 years.

- A trillion seconds is 31,688 years pic.twitter.com/imf633mmT6

And if you'd rather have a visual for it, here you go:

This is what $1 Trillion in USD looks like. It’s “printed” every 100 days. Looks like a lot. pic.twitter.com/nbXVYJOTwd

— Gabor Gurbacs (@gaborgurbacs) March 25, 2024

So, the US owes $35T in straight debt plus another mind-boggling $218T in unfunded liabilities.

One thing that can make things even worse is dogmatic, bone-headed policies. Ask Germany, the poster-child of bone-headed dogmatic policies:

Good Morning from #Germany where the once-mighty industrial giant ThyssenKrupp is now trading on the stock exchange at no value. The company's shares reflect a negative enterprise value due to a mix of poor management and the challenges of operating in Germany. pic.twitter.com/nVcmRwpmWm

— Holger Zschaepitz (@Schuldensuehner) August 30, 2024

Good Morning from Germany, where deindustrialization is picking up speed. For the first time in its 87-year history, VW is considering closing factories in Germany—a move that breaks w/tradition and could lead to conflict w/unions. This decision highlights the deep troubles in… pic.twitter.com/JdmMevlHkY

— Holger Zschaepitz (@Schuldensuehner) September 3, 2024

So, let's be grateful that a few in the US media are now starting to push back against dogmatic, boneheaded policies.

CNBC host goes to war with Kamala Harris’ economic advisor over taxing unrealized gainspic.twitter.com/fxNP8WsMQu

— Exec Sum (@exec_sum) August 28, 2024

I expect choppy waters to continue through the elections. Holding some sats through the turbulence helps me keep my sanity.

Price News

Bitcoin Surfing

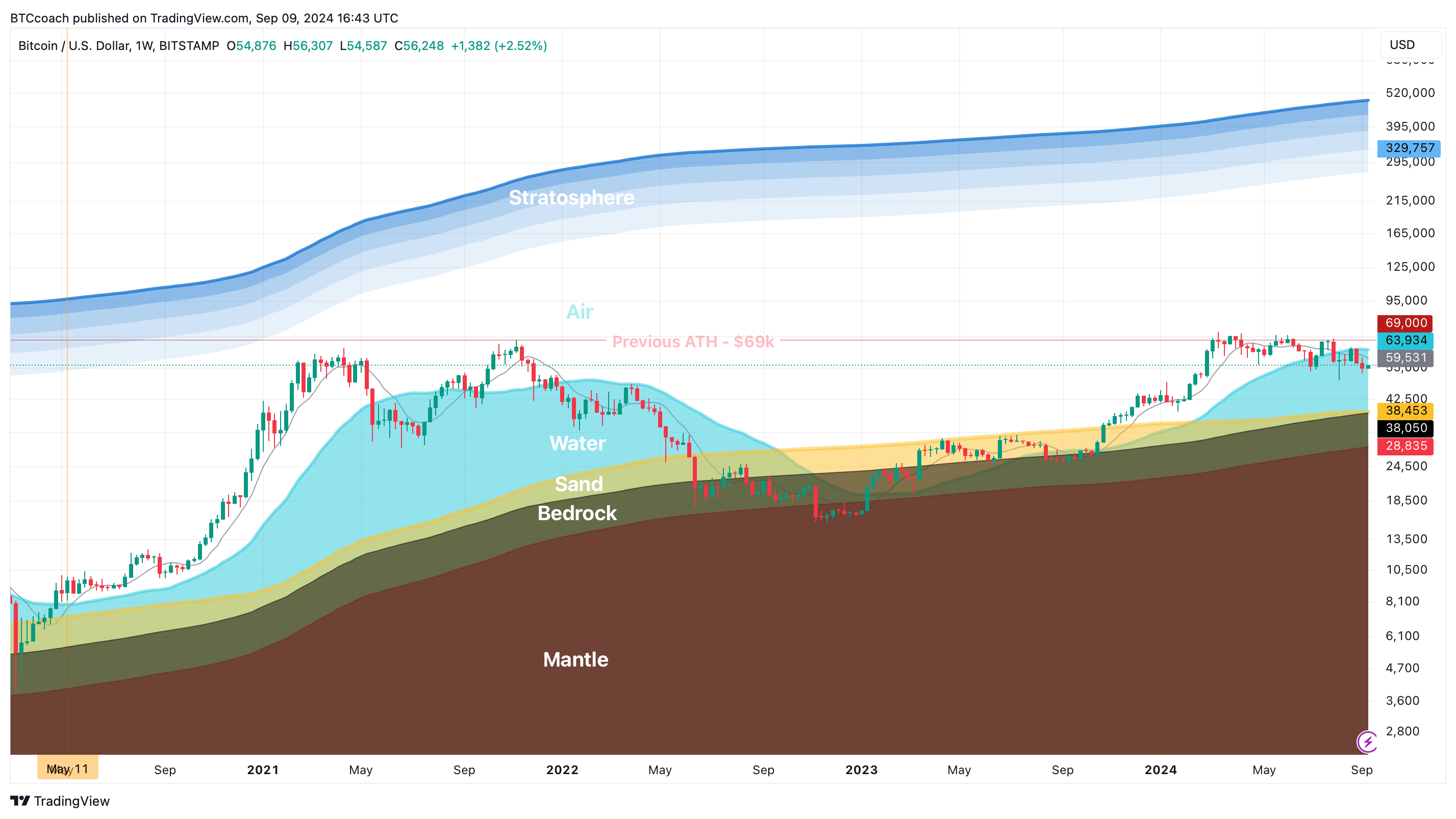

Bitcoin went snorkeling last week and remains well below the Water ($63.9k) level. The Board (at $59.5k) could provide some support, but we may have to wait 'til October to find the energy for an upward push.

Dip Fishing

After breaking the $60k support Bitcoin tried to bounce back before falling below the $56k support, which it's currently trying to recapture. If it fails we could see $50k again.

Calm Chart

August closed red and September is likely to be the same if history is any guide. September has usually been good for bargain hunting in Bitcoin.