This is Fine

Bitcoin pumped a bit last week, what seems to be driving it?

In my opinion two major developments:

- RFK's endorsement of Trump, and

- Jay Powell's pre-announcement of rate cuts (coming soon)

1- TEAM OF RIVALS

In a moving, articulate and rather remarkable speech, RFK announced he'd be backing Donald Trump and excoriated the Democratic Party —of which he has been a lifelong member.

NOW - RFK Jr. says the Democratic Party "has become the party of the war, censorship, corruption, big pharma, big tech, big money."pic.twitter.com/CDSCWXC7pb

— Disclose.tv (@disclosetv) August 23, 2024

True to form, the mainstream media did their best to downplay and ignore him. CNN bracketed his speech as an explanation of what led RFK to drop out of his "quixotic quest" for the White House and cut off the feed mid-speech.

🚨CNN cut away from RFK Jr's speech as he was explaining how the DNC rigged the primary, replaced their candidate with one who didn't receive a single vote, and how the media covered up for it and censored him. pic.twitter.com/sQfGcmWKWT

— Greg Price (@greg_price11) August 23, 2024

The speech was a fine piece of political oratory and —regardless of what you think of RFK's politics— is worth listening to in its entirety (I've provided a link below).

Many people hung on to this (admittedly solid and moving) line from the speech:

“What if we love our children more than we hate each other?” —RFK JR.

But the idea that really rocked my boat —as this sentiment is sorely missing in today's "sell your soul" flavor of politics— was the following:

“We talked about Abraham Lincoln's team of rivals. That arrangement would allow us to disagree publicly and privately, and fiercely… on issues over which we differ while working together on the existential issues upon which we are in concordance.” —RFK JR

Apparently this is not only a work-related philosophy, but one that carries over to home. RFK explicitly mentioned his wife's struggle with his decision:

"I made a political decision with which she is very uncomfortable." —RFK

Again, I encourage you to listen to the whole thing:

The rumors were true! The rumors weren’t true! To find out what’s really true about my next steps in service to the mission that launched my campaign, in my own words, please watch this video of my press conference today. pic.twitter.com/9WyNrFAlq3

— Robert F. Kennedy Jr (@RobertKennedyJr) August 23, 2024

In the last weeks I'd seen many Bitcoiners split between whether they'd vote for Trump or for RFK (who is clearly ahead in the BTC learning curve), the divide has now been resolved.

While Bitcoin was not at all mentioned during any of these proceedings, it's clear that a Trump + Vance + RFK team would be supportive of —or at the very least not actively hostile towards Bitcoin.

2- ADJUSTING

Last week J-Pow hinted at rate cuts in the near future. Precise size, timing and pace of same depending on the ripeness of his plums incoming data.

He also mentioned:

- Looser policy could lead the economy back to 2% inflation, while maintaining a strong labor market (which he doesn't want to cool further).

- Economy continues to grow at a solid pace

- Upside risks to inflation have diminished

- Downside risks to unemployment have increased

Jerome Powell: “We do not seek or welcome further cooling in labor market conditions.”

— TFTC (@TFTC21) August 23, 2024

“The time has come for policy to adjust.”pic.twitter.com/9PMA0AavtZ

First-order thinking is "lower rates are good for risk assets" because people seeking returns can no longer sit in "risk free" bonds (we'll come back to this), so the stock market seemed to welcome the news.

BREAKING: The S&P 500 rises 1.5% after Fed Chair Powell says "the time has come" for Fed rate cuts.

— The Kobeissi Letter (@KobeissiLetter) August 23, 2024

Now, the S&P 500 is officially up more than 10% from its August 5th low.

In other words, the index has added back over $4.5 TRILLION of market cap in just 3 weeks.

The Fed pivot… pic.twitter.com/v9LB7cVWoe

But there are several odd things about this whole situation.

First, rates are usually lowered in response to economic downturns or sluggish growth (with the goal of stimulating borrowing, spending, and investment).

Yet:

- The S&P 500 is near record highs

- Employment (allegedly) is running hot, and inflation, even the official numbers, are above the mystical 2%

So what's really going on? Maybe the numbers are bullshit?

4 out of the latest 5 months of jobs numbers have been revised downward with the latest numbers receiving the largest (downward) revision in 15 years.

The Federal Reserve could see "up to a million" US jobs disappear in what might be the largest downward revision in 15 years, according to Bloomberg. pic.twitter.com/aPFRV7NxJO

— TFTC (@TFTC21) August 20, 2024

Single-digit inflation numbers are certainly bullshit, which is easy to prove if you haven't given up on the habit of eating.

BuT GoVt sAyS InFlAtiOn is OnLy 3% pic.twitter.com/PhMWU9kGiu

— Guy Swann ⚡️| Activate Covenants (@TheGuySwann) August 23, 2024

Delightfully, even in the MSM you can start seeing pundits push back against the bullshit narrative that food is expensive because of price gouging:

LMAO CNBC has had it with Warren’s BS😂🤣😂🤣 pic.twitter.com/PiAxjn4676

— Spitfire (@DogRightGirl) August 23, 2024

And, —I hope this doesn't shock you— it's not just food and groceries going up.

*GOOLSBEE: THIS IS WHAT THE PATH TO 2% INFLATION LOOKS LIKE

— zerohedge (@zerohedge) August 23, 2024

oh, it looks like this? pic.twitter.com/YwR9vfeOls

Rate cuts are likely to drive inflation higher, so why lower rates again?

The reality is the US can no longer afford high interest rates, they make their debt too expensive:

Things could get very interesting if the Fed starts cutting interest rates while inflation picks up again, forcing them to ignore it, given that the US can no longer afford a restrictive policy.

— Otavio (Tavi) Costa (@TaviCosta) August 22, 2024

I am very open to that view. pic.twitter.com/3fj8S1RYBx

The difference between "expensive" and "too expensive" rates is spelled out neatly by Michael Burry, of Big Short fame:

Michael Burry: When the interest on your debt eclipses your tax income, your country is a Ponzi scheme 👀

— Bitcoin News (@BitcoinNewsCom) August 25, 2024

pic.twitter.com/F99JmpiKGO

And remember, the government doesn't just owe the interest (and principal) on the debt it has issued ($35 Trillion which could arguably be repaid by printing), it also owes its citizens Social Security and Health services which can't simply "be printed".

$35 trillion of debt plus another $218 trillion of unfunded liabilities, and not a *peep* from either candidate about it. pic.twitter.com/PgF3pYM7CJ

— James Lavish (@jameslavish) August 19, 2024

It's worth mentioning that many consider a loosening of Fed policies as a precursor to "firing up the money printer" —the Fed expanding its balance sheet which has historically driven BTC prices upward.

It's worth taking a moment to review what the above seems to suggest for the stock market specifically:

Notes on The Stock Market

Japan carry trade weekend crisis notwithstanding, the stock market has been BOOMING. Are we in the "up forever" phase now?

Remember a few paragraphs back we said "rate cuts are good for risk assets"? It turns out historically, the stock market has often reacted negatively to rate cuts.

Why are people excited about rate cuts when they often signal the market’s peak? pic.twitter.com/mSffO1cpnf

— Bitcoin News (@BitcoinNewsCom) August 16, 2024

The market's reaction is heavily context-dependent and can't easily be predicted by mortals at my pay-grade, but there's additional context (the yield curve uninverting, one more of those financial astrology things) which suggests a market correction might be due.

The 2 vs. 10-year spread is about to un-invert.

— Otavio (Tavi) Costa (@TaviCosta) August 21, 2024

The yield curve is sending a clear message about the potential direction of the economy in the near future, while markets continue to stubbornly ignore these signs.

The reality is:

Rate cuts late in the cycle have never ended… pic.twitter.com/Y4XZ8uxs0J

From where I'm sitting the stock market is overheated…

THIS IS TRULY REMARKABLE:

— Global Markets Investor (@GlobalMktObserv) August 25, 2024

US household allocation to stocks hit 57% of total, near the highest level EVER RECORDED.

The percentage has more than DOUBLED in ~15 years.

This is now also in line with the 2000 Dot-Com Bubble peak.

US households are all-in stocks. pic.twitter.com/DIdWO0voWh

So the market seems caught between conflicting dynamics, on the one hand several indicators are signaling an impending (and in my opinion healthy) pullback, but on the other hand we have:

- A cardinal rule of politics: "don't tank the market if you want to get re-elected"

- The government's (heavy) dependence on capital gains tax as a source of revenue

So we'll have to wait and see how things shake out. Remember

- Markets are not "efficient"

- Markets are not "forward-looking"

Markets are fickle and stubborn and driven by multiple competing forces which wax and wane over different time-frames.

Moving on

Speaking of Capital Gains, Kamala is proposing to increase that tax to an all-time-high along with a batshit crazy bold plan to tax unrealized (paper) capital gains if you make more than $1M per year.

Kamala Harris supports raising the U.S. corporate tax rate from 21% to 28%, reversing Trump's cut.

— TFTC (@TFTC21) August 20, 2024

She is also backing Biden's proposal for a 44.6% capital gains tax, the highest ever, along with a 25% tax on unrealized gains for high-net-worth individuals. pic.twitter.com/IohoVcD6az

She also paid a bit of rather hollow-sounding lip service to "crypto" despite keeping Elizabeth Warren's "anti-crypto army".

JUST IN: Kamala Harris "supports policies to expand crypto industry", Bloomberg reports 🇺🇸 pic.twitter.com/h7qBOJm42a

— Bitcoin Magazine (@BitcoinMagazine) August 21, 2024

If we step back and look at the big picture, I'm still extremely bullish on the medium and long term, for the precise reasons Dalio states below.

hedge fund legend ray dalio: “bitcoin has imputed value… because of the depreciation of fiat, there will be a competition of monies, and #bitcoin is part of that competition.” pic.twitter.com/jZDLtMYicl

— Alex Thorn (@intangiblecoins) August 25, 2024

A growing portion of the market seems to recognize BTC's qualities as well:

1/ Bitcoin ETFs are being adopted by institutional investors faster than any other ETF in history. Don't believe the "it's just retail" story. The data prove otherwise.

— Matt Hougan (@Matt_Hougan) August 21, 2024

A thread.

And it's worth mentioning there has been strong selling pressure for Bitcoin which is coming to an end.

VanEck’s Head of Digital Assets, Matthew Sigel, says the forced selling of #Bitcoin is over.

— TFTC (@TFTC21) August 19, 2024

"The history is that Bitcoin really hits its stride at that point, so we're buyers here."pic.twitter.com/RcJPtLy5Sk

And if Microstrategy does get added to the SP500 —which it may— that could raise BTC's profile even more

$MSTR will VERY LIKELY be announced to be added to Nasdaq-100 $QQQ Index on December 13th, 2024

— Jeff (@PunterJeff) August 23, 2024

The largest publicly traded #Bitcoin HODL’er will be added to the 5th largest index ETF in the world

There are only 100 global equities that make the cut

Prepare accordingly pic.twitter.com/Z5p4EXhO6B

Price News

August has been a wild and terrible ride for Bitcoin —if you had leverage.

This is one of the craziest monthly candles in Bitcoin's history. pic.twitter.com/qUaPS1VKQ4

— ₿ Isaiah 58k Gang (@BitcoinIsaiah) August 23, 2024

"Wicks do the damage" is a perfect summary of why BTC and leverage don't mix.

Wicks do the damage, bodies tell the story. 🔎 $BTC pic.twitter.com/YbOwTJgsS7

— TrendSpider (@TrendSpider) August 24, 2024

A final reminder: Most of BTC's yearly gains happen inside of 10 days out of the whole year, staying in the sidelines hoping to catch the lows and highs is not a good strategy.

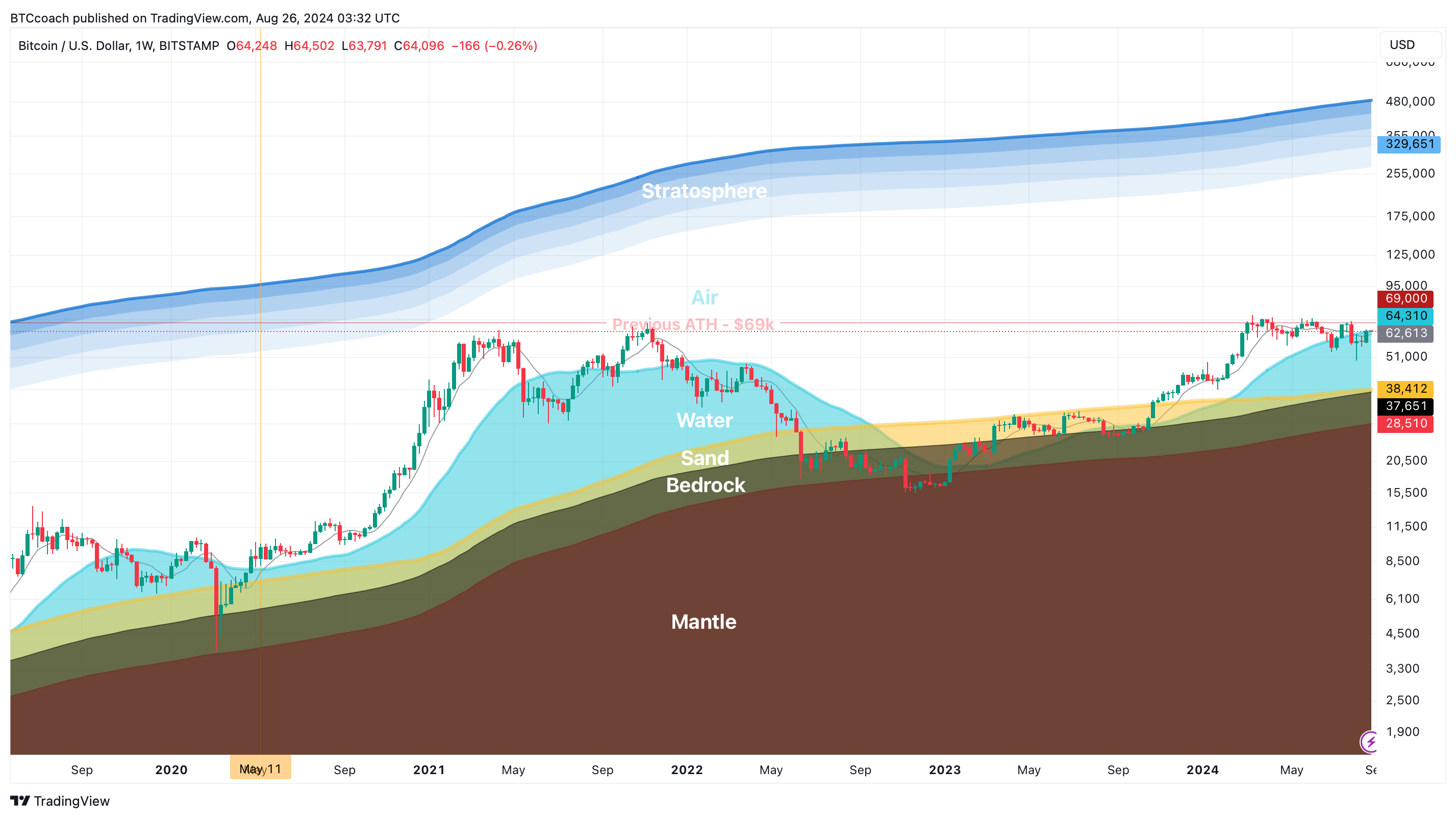

Bitcoin Surfing

Against my expectations Bitcoin boldly hopped back on the Board ($62.6k) and is trying to keep its nose out of the Water ($64.3k)

Dip Fishing

BTC jumped up 2 resistances and is currently banging its head against $64k. IMO we could easily see $62k and maybe $60k again $56k or lower would require a shock to the system, but those seem to be coming more frequently these days.

Calm Chart

The August monthly chart almost flipped Green after the Fed announcement and is now very modestly red, a nasty downward wick notwithstanding.