Was the Japan carry trade a nothing burger?

What looked like the beginnings of a huge market crash on Monday —and make no mistake, the numbers were scary even for market veterans—seemed to dissolve into "nothing burger".

After posting its worst and best day in over a year, the S&P 500 just closed the week down 2 POINTS.

— The Kobeissi Letter (@KobeissiLetter) August 9, 2024

That's a 0.04% decline in a week when the $VIX hit 65.

Truly anything is possible in this market. pic.twitter.com/rNXviytePP

Are you not entertained? —Maximus Decimus Meridius

Telling my grandkids this was the Great Depression pic.twitter.com/KUGezAKWA3

— Trung Phan (@TrungTPhan) August 6, 2024

It's worth mentioning that institutions bought the dig aggressively while retail was unable to access their trading accounts (yes, they are laughing at you)

JUST IN: JP Morgan says Institutions bought the dip while Retail panic-sold aggressively.

— Radar🚨 (@RadarHits) August 6, 2024

Retail sold -$1 BILLION

-2.5 standard deviations BELOW the 12m average

Institutions bought +$14 billion

+2.9 std dev ABOVE the 12m average pic.twitter.com/4rDyNCbq0t

Even though it was short lived, the acute spike in volatility was real and should serve as a warning of the current fragility of functioning markets.

The wrong takeaway would be to assume they'll always be able to put the genie back in the bottle.

Yeah this was a weird one (and I think probably over already?) pic.twitter.com/R66zIJxdBu

— Travis Kling (@Travis_Kling) August 6, 2024

What happened?

The collision of heavy leverage with sudden, unexpected market movements.

Write that sentence down because —even though they managed to contain it this time— that is the very phenomenon that could trigger the next market dislocation and it is by no means limited to the Japan Carry Trade

Specifically, Japan's Central Bank (BOJ) tried to raise rates by 0.25%, and that was enough to f*ck up the market because there was TONS of leverage tied to financial strategies that depended on Japan keeping a negative (or zero) rate policy.

Stock markets around the world are crashing right now, but why?

— The Kobeissi Letter (@KobeissiLetter) August 5, 2024

The answer to this question is the Yen carry trade, a term you'll probably hear many times this week.

So what exactly is the Yen carry trade and why did it cause a market downturn?

A thread to explain:

(1/7) pic.twitter.com/0G5MnsV49I

Here's a refresher on the Yen Carry Trade

In an unexpected and embarrassing about-face —Gov Uchida was probably refused a request to commit sepuku— the BOJ walked back their rate increase on Wed.

"We will not raise interest rates when financial markets are unstable…"

—Shinichi Uchida, Governor, BOJ

Even stranger, a few days later they also promised hinted they won't try to raise rates again this year.

Makoto Sakurai, a former member of the Bank of Japan's board of directors, said that the Bank of Japan will not raise interest rates again at least for the rest of this year, but whether it will raise interest rates once before March next year is still an uncertain question.…

— Wu Blockchain (@WuBlockchain) August 12, 2024

Is it just me or does it sound like BOJ got a call from Sec. Yellen explaining they're not allowed to blow up the economy right before a US election?

But why is the Yen a US problem again?

Japan is now at the center of emergent worries — across everything, stocks, bonds, yen, credit, everything." —Stephen Miller, Grant Samuel Funds Management, formerly at BlackRock.

The weakness or strength of the Yen is important because Japan owns a LOT of USD denominated assets (including government debt, equities, hard assets, etc) and if the Yen gets too weak, Japan may be forced to sell some of these US-denominated assets in order to bring that money back home and prop up the Yen and contain local inflation.

The ECB is warning of a global bond market meltdown if the Bank of Japan changes their policy.

— Stack Hodler (@stackhodler) June 1, 2023

Japan has propped up global debt markets by pumping $3.4 Trillion into foreign markets.

But sticky inflation could force those capital flows to reverse, leading to a debt tsunami. pic.twitter.com/BmXZaOc6HR

If you want to understand why such a small change in an overseas market almost crashed the economy this is what you need to get:

the story from Monday is how quickly the entire spectrum of markets – stocks, Treasuries, corporate bonds, munis, currencies, and the derivatives complex – can dislocate into illiquidity

Quote above is from tweet below, which has a good link to a lot more info:

DOUG ☕️: “Crisis dynamics triggered a policy response, a familiar scenario. That it was the Bank of Japan quelling global crisis dynamics was highly unusual…the story from Monday is how quickly the entire spectrum of markets – stocks, Treasuries, corporate bonds, munis,… pic.twitter.com/F9X7lfPAnZ

— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) August 10, 2024

So, why did Bitcoin sell off so aggressively?

Some people like to say BTC is correlated to this or that market, not realizing BTC correlation to other markets changes over time.

Bitcoin hasn't been strongly correlated to gold or the stock market for some time now.

— ecoinometrics (@ecoinometrics) August 7, 2024

While we see occasional spikes in correlation, it's nothing like what we observed in 2020/2021.

This could change if we experience a synchronized crash and subsequent recovery. In such… pic.twitter.com/NPFqhJ8MaY

But one thing BTC is —and I suspect always will be— highly sensitive to are liquidity crises.

A liquidity crisis occurs when there is a sudden, sharp decrease in the availability of credit or money in the financial system which can lead to panic and uncertainty among investors and borrowers, as they struggle to access cash or fund their operations.

One of the main features of a liquidity crisis is an urgent need for cash as traders get margin-called. Try selling real estate overnight, or gold bullion in size on a Sunday.

The bitcoin market's liquidity may not as deep as gold or oil markets but is available 24 x 7 globally, which means it's easiest (and thus first) thing to sell.

Liquid assets always be liquidated first in liquidity crises.

— 🏔Adam O🏔 (@denverbitcoin) August 6, 2024

Bitcoin is insanely liquid…try and sell $275k of gold at 11:27pm on a Sunday. A great point here: https://t.co/XWGrGYLRfk

Luke Gromen calls Bitcoin "the last functioning fire alarm" in the market. Meaning, if you see BTC go down wildly, there's a good chance a deleveraging (usually followed by a liquidity crisis) is brewing.

Remember, wild price swings are often caused by (and always amplified by) leverage games. Trying to "overstack" (buying more you can afford) through leverage is a dangerous game.

This is why 99% of your portfolio should be in spot

— Rex (@R89Capital) August 8, 2024

Every single person using leverage on both sides has been carried out in a fucking body bag lol pic.twitter.com/env4JYCBtg

Most long-term holders held tight as leveraged speculators were forced to sell.

Over 💵 $5.2B worth of #Bitcoin was moved by short-term holders within a week.

— Bitcoin News (@BitcoinNewsCom) August 6, 2024

In contrast, long-term holders largely held onto their BTC.

Of the $850M in realized losses, only $600K originated from long-term holders. pic.twitter.com/RXDPS6L6iB

To their credit, most ETF holders held tight too, good for them!

So $IBIT investors woke up on Monday to a -14% move over wknd after stomaching an 8% decline the week prior and what did they do? ABSOLUTELY NOTHING. $0 flows. Compared to some of these degens these boomers are like the Rock of Gibraltar. You guys are so lucky to have them. pic.twitter.com/Qqg9Y2E40k

— Eric Balchunas (@EricBalchunas) August 6, 2024

Of course, this makes even more sense when you consider the ETFs don't share BTC's liquidity profile (because they only trade during trad-fi market hours). Ironically, this point was absent in what would have otherwise been a banger from goldbug and anti-BTC engagement post professional, Peter Schiff:

Owning #Bitcoin in ETFs defeats the entire purpose of owning it in the first place. It's no longer decentralized, its not peer-to-peer, it's easily seized by authorities, can't be used as a currency for payments, or transferred across boarders. It's not your keys, not your coins.

— Peter Schiff (@PeterSchiff) August 6, 2024

And of course, the triple maxis are doubling down and getting ready to buy more.

Public companies raising to buy more BTC

— Vivek⚡️ (@Vivek4real_) August 6, 2024

🇺🇸 Microstrategy: $2 billion

🇺🇸 Semler Scientific: $150 million

🇯🇵 Metaplanet: $70 million

Are you paying attention? 🚀 pic.twitter.com/2TGQvCA8fb

Back in Fiatland

Craig Shapiro asks a good question: Who wants long term Gov debt under these conditions? Gromen: "idiots" (I'm paraphrasing a bit).

LT sovereign bondholders' real purchasing power today are the functional equivalent of the real purchasing power of US union factory worker wages in 2002, shortly after China had entered the WTO in late 2001:

— Luke Gromen (@LukeGromen) August 7, 2024

About to be crushed, but as yet, still unaware of that eventuality. https://t.co/3s3syhidOS

Gromen also connects the dots between the Yen crisis and last week's poorly received 10-Yr US Treasury auction, concluding the fragile balance required to keep markets from breaking not only makes sovereign long-term debt unappetizing but will lead to a point that can only be resolved by either allowing the markets to crash or firing up the money printer.

JPY "too strong" = global markets dysfunction, which quickly leads to UST dysfunction.

— Luke Gromen (@LukeGromen) August 7, 2024

USD "too strong" = UST markets dysfunction, which quickly leads to global markets dysfunction.

Powell ultimately only has a choice of how he wants to lose the long end - "fire" or "ice"?… https://t.co/7xMxVFNDvk

Epstein buddy and "Lolita Express" passenger ex Treasury Secretary Larry Summers says the quiet part out loud. Excessive debt is sapping US power

Perhaps the world's greatest debtor can't remain the world's greatest super power. It’s a 1938 like moment and that coupled with the complexity of our internal challenges makes this a very, very serious moment.

— Lawrence H. Summers (@LHSummers) August 3, 2024

Watch my interview from @AspenEcon with @DavidWestin @BloombergTV…

US debt's parabolic path to infinity and beyond has allowed interest payments to overtake military spending

"Who could defeat the US military?"

— Luke Gromen (@LukeGromen) August 8, 2024

Compounding interest is defeating the US military👇& compounding interest is undefeated v. hegemons.

Buy LT USTs if you think the US will lose Cold War 2.0 for lack of printing enough USDs to finance this; if not, buy gold, BTC, & stocks. pic.twitter.com/qcqaGfRM00

The big takeaways from last week for me are:

- unexpected movements can easily upset the fragile balance of the markets.

- last week's deleveraging was an small preview, there is plenty more where that came from.

- liquidity crises can provide great buying opportunities if you have the cash, the stomach, and a trading platform that doesn't lock you out.

Oh yes

I almost forgot we're all about politics now. Kamala wants to reset her administration's stance towards crypto, so she started by reaching out to the sh*tcoiners because of course she did.

Not like that 😂🤦♂️

— Cory Klippsten 🦢 Swan.com (@coryklippsten) July 29, 2024

"Kamala Harris's campaign is making strategic moves to reconnect with key crypto firms like Coinbase, Circle, and Ripple Labs."

In a zoom call she did not attend they tried to pretend operation chokepoint was not a thing …that did not go well.

👀 https://t.co/nlCsD1dZQM pic.twitter.com/ixwKd9OdwF

— Alexander Grieve (@AlexanderGrieve) August 9, 2024

The rest of the newsletter has been redacted because I don't want to be arrested for WrongThink in the UK ; )

Price News

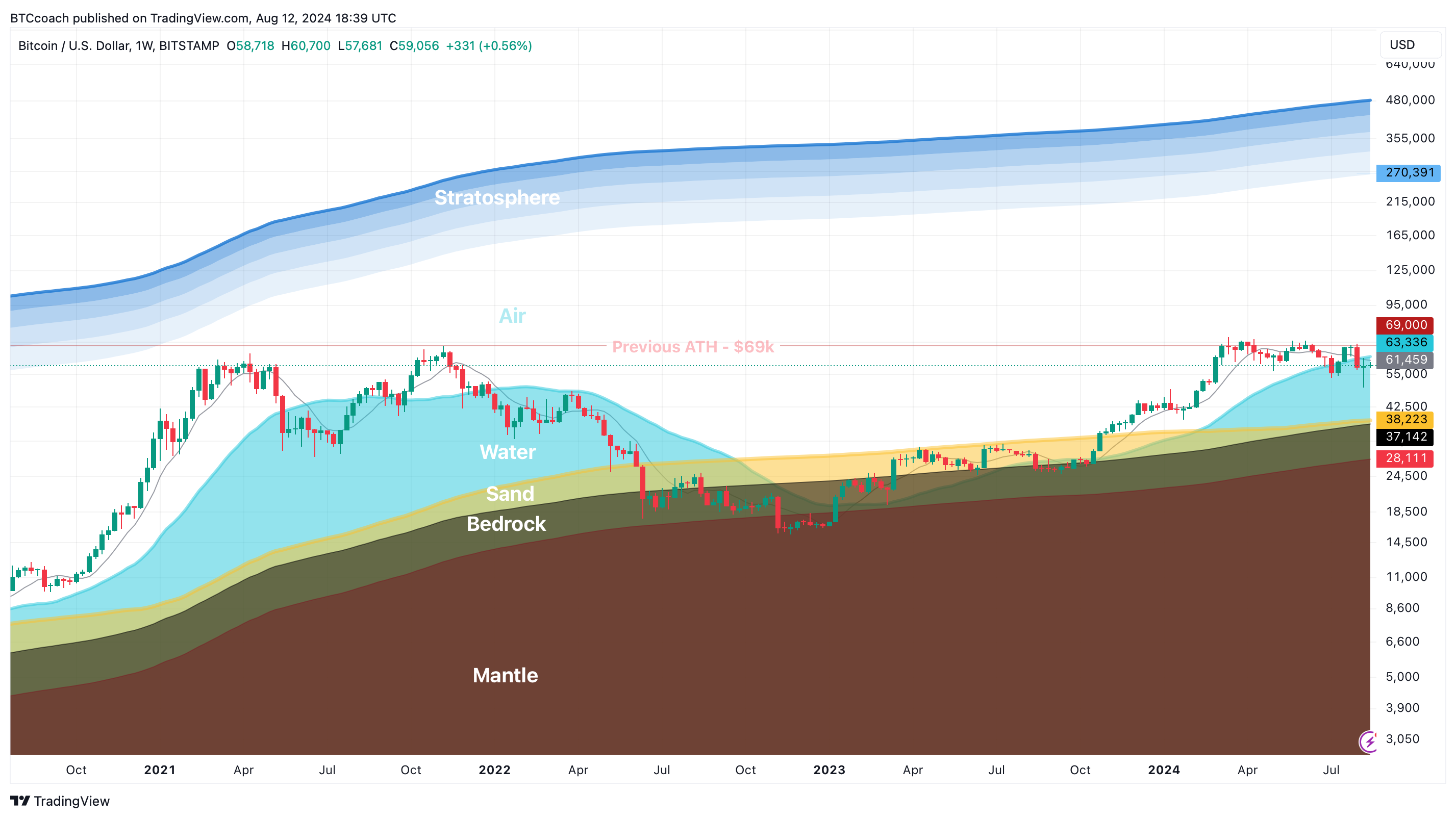

Bitcoin Surfing

After ending almost flat (despite a steep dive) last week, price is trying to reach for the Board ($61.4k), so far unsuccessfully.

Dip Fishing

After last week's swan dive price bounced back quickly and has been trying to regain the $60-$62.5k channel, %56k could still be in the cards.

Calm Chart

August remains red. I assume it'll remain so but it's hard to tell these days. PS. These kinds of resets make for very healthy soil for bull runs