2024.11 - Sayling

IMHO:

It seems Bitcoiners aren't happy unless they disagree vehemently over something.

The ETFs replaced ordinals/JPGs as the topic du jour, but last week it was Microstrategy's (MSTR) turn.

Disclaimer: I bought a few shares of MSTR back in Sep 2020 (after watching Saylor discuss his decision with Pomp) and added a bit more in 2023. It's not a large position but it is up a ridiculous amount, so I'm not pretending to be an objective observer here.

Saylor's Microstrategy was famously the first company to switch from the USD to BTC as their treasury reserve asset.

They stacked with conviction through the bear market, repeatedly using cheap debt to buy more Bitcoin

What is MicroStrategy doing with #Bitcoin ?

— Jesse Myers (Croesus 🔴) (@Croesus_BTC) March 15, 2024

They are borrowing a depreciating asset to buy an appreciating asset.

And they can (and will) keep doing it, whenever $MSTR trades at a premium to the underlying BTC they hold. pic.twitter.com/zHqSBWPneZ

They have not let up as the bull market starts, stacking relentlessly as they close in on owning a full 1% of the entire BTC supply.

MicroStrategy Completes $800 Million Offering of Convertible Notes at 0.625% Coupon and 42.5% Conversion Premium $MSTR https://t.co/c9TEzMqQHq

— Michael Saylor⚡️ (@saylor) March 11, 2024

The market has rewarded them with a very rich premium to their BTC holdings, causing controversy over whether this is deserved or not.

Since Jan 2024:

— Luke Mikic⚡️🇸🇻🇦🇺 9-5 Escape Artist (@LukeMikic21) March 15, 2024

🟢Bitcoin = +64%

🔴MicroStrategy = +250%

Either MSTR is due for a hefty pullback, or the Bitcoin critics are about to lose their mind as Bitcoin plays catch up.😂🚀 pic.twitter.com/kyvpL5HTdJ

One side argues that MSTR "is a shitcoin" while others explain it represents a new market structure to leverage fiat debt in order to accumulate BTC

MicroStrategy was understood to be a way for equity market capital to get #Bitcoin exposure pre-ETFs but what still isn't fully understood is MSTR is a way of bond market capital to get Bitcoin exposure.

— Vijay Boyapati 🦢 (@real_vijay) March 15, 2024

And the bond market is much larger than the equity market. https://t.co/6t17rNrIUD

The argument was already heated when Michael dropped a viral bombshell during an interview as he tried to explain his "no selling" strategy in terms of capital preservation:

People that use fiat currency as a store of value, there's a name for them. We call them "poor".

It's a well-argued point and worth listening to:

real pic.twitter.com/2TB48tbwN5

— Dylan LeClair 🟠 (@DylanLeClair_) March 12, 2024

But as you might imagine, Twitter had an absolute field day with the quote and the arguing intensified. Meanwhile, Saylor stacked some more.

Saylor raised $800 million to buy more bitcoin 2 days ago, went on Yahoo Finance and called people who save in fiat poor, and now he’s raising another $500 million to buy more bitcoin

— Nik (@nikcantmine) March 13, 2024

What a legend 😂😂😂

Here's three arguments I find compelling:

1- The Flywheel effect

If/when another corporation tries to copy MSTR's playbook, they will inevitably increase the value of MSTR's BTC holdings

Microstrategy cannot be replicated on the same scale without spending $15 billion at $72k and removing about 10% of the available #Bitcoin on exchanges - this rules out most companies except mega caps.

— supplyshocks (@supplyshocks) March 13, 2024

Price of #Bitcoin would rise further on this demand and publicity, and would… https://t.co/Ndhnd7BE3p

2- The S&P Effect

As it continues to rise in Market Cap, MSTR could become eligible for inclusion in the S&P —mind you this is not an automatic process and the committee in charge could simply choose not to include it— but IF it does get added at some point, a number of funds will be forced to buy it algorithmically, boosting its price even further.

If MSTR is added to the S&P500, index funds have to buy it according to its market weight, which boosts its price, which increases the MSTR premium allowing Saylor to issue more equity & debt to buy more BTC, which makes BTC go up, which increases MSTR & index weight, etc…

— Matthew Pines (@matthew_pines) March 11, 2024

🤔 https://t.co/uD8aBBzeDt

3- Schrodinger's Stock

Preston points out it's futile to use traditional metrics to value MSTR because they're doing something that's never been done before.

If you think you can value MSTR right now, congrats on expending energy on a fools errand.

— Preston Pysh (@PrestonPysh) March 13, 2024

What’s the value of a profitable company that holds nearly 1% of new global money supply?

So, is anyone copying MSTR's playbook yet?

As far as we can tell no. But Coinbase's recent debt offering is fueling rumors that they may be thinking of giving it a go (if history rhymes they'll probably use the money to buy shitcoins instead).

Coinbase is probably following Microstrategy’s playbook and buying #Bitcoin

— Vivek⚡️ (@Vivek4real_) March 12, 2024

You are not prepared for what's about to come. pic.twitter.com/BjptQbmyB8

At the risk of pointing out the obvious, if you are buying MSTR here you'd better be thinking long-term, given it already carries a very rich premium.

Although arguably, the same could be said about most top-performing stocks at the moment (particularly the "Magnificent 7).

Apollo just doubled down on their view that we are in a bigger bubble than the 2000 Dot-com bubble.

— The Kobeissi Letter (@KobeissiLetter) March 13, 2024

3 weeks ago, they said the current bubble is "bigger than the 1990s tech bubble."

They note that the Forward P/E ratio for the top 10 tech stocks right now is ~40x.

Compared to… pic.twitter.com/xZqUAU0nKl

One final key element in all of this is Michael Saylor himself. There is significant "key-man" risk in MSTR as it is unclear anyone would be able to "carry the torch" if Saylor went missing.

But life carries risk and anyone who says different is trying to sell you something. And if you think old "blue chip" stocks, like say Disney, are less risky Michael Saylor has a few words for you:

I suggest people study the history of Disney. They're a great example of every kind of risk [to shareholders].

— Anil ⚡ (@anilsaidso) March 13, 2024

—@saylor pic.twitter.com/FyecxhjmLu

Me? I bet on the Gigachad years ago, held through a tough winter and am looking forward to seeing what the hell he does next. Whatever it is, I know he'll keep stacking.

If you wanna know why some of us fuck with Michael Saylor heavy, it’s because we prophesied this man.

— HODL (@americanhodl8) March 18, 2024

Nocoiners would say shit to us like, who’s gonna buy #BTC for 100k? And we would be like “idk some rich guy”

Well now he’s here. The random rich guy we said was coming… pic.twitter.com/hWfL8E2NvF

You can make fun of Saylor fanbois all you want, but if you're thinking of betting against him I suggest you check out today's Price Action section before you hit BUY on those shorts.

Bitcoin News

Unlevered

Those who think they can get rich using leverage to trade Bitcoin get REKT. Leveraged traders is one of the reasons Bitcoin will remain volatile for the foreseeable future. If you can't deal with this, BTC is not for you.

This candle is called "liquidate the degen leverage ATH longers"

— hodlonaut 80 IQ 13%er 🌮⚡🔑 🐝 (@hodlonaut) March 12, 2024

Don't get greedy pic.twitter.com/98aTYTlY5a

Still Strong

ETFs are not slowing down.

UPDATE (3/15)

— Thomas | heyapollo.com (@thomas_fahrer) March 16, 2024

Bitcoin ETF Net In Flows +2.8K #BTC

New All Time High 836.3K BTC Held in ETFs

New 9 ETFs + 4.6K BTC

Highlights

Fidelity + 2.2K

Blackrock + 2K BTC

GBTC -2K

Follow our ETF tracker for live updates pic.twitter.com/kp47vvgus3

Over the next few months, corporations who've been buying will need to disclose their positions. We wait with inteerst.

For everyone wondering "who is buying" bitcoin ETFs, I'd circle May 15th on your calendar.

— Matt Hougan (@Matt_Hougan) March 13, 2024

Investors with more than $100m in AUM have to file reports with the SEC called "13-F Filings" disclosing their publicly traded holdings.

Those filings are due 45 days after the end of…

Matt Hougan from Bitwise has been on the road promoting his ETF and he provides some color on what that's been like (in short, strong interest).

Day 3 of 20 on the road talking to financial advisors and family offices about bitcoin. Some initial take-aways:

— Matt Hougan (@Matt_Hougan) March 13, 2024

1) I am no longer surprised at the size of the inflows into the bitcoin ETFs. The demand is widespread and strong, and will persist for a while. Interest is very…

And if Patient Capital Management is any hint, allocations of up to 15% could become the norm.

Breaking: $1.7t Patient Capital Management just filed with the @SECGov to buy #Bitcoin ETFs with up to 15% of its Opportunity Trust Fund. 👀

— MartyParty (@martypartymusic) March 12, 2024

15% is the new institutional fund allocation number people. Thats huge. 👀https://t.co/Xd6p4wg7Mb pic.twitter.com/dJH9bQwwMB

Mostly 100

Some entity, nicknamed "Mr. 100" has been buying 100 BTC per day on most days. On dips he buys more. We now know the demand is coming from South korea, but we don't yet know who's behind the wallet. Some speculate it's a nation state. Sooner or later this will be true.

I believe Mr. 100, who's been buying #btc in the hundred per day since Novermber of last year is a small to medium sized nation state.

— Oliver L. Velez ⚡️ 13%'er Bitcoiner (@olvelez007) March 14, 2024

Nation states will never buy the ETF.m of another country. They only buy the real thing and self-custody the real thing, just as they do… https://t.co/XeAeseUh7e

That's Cold

El Salvador has moved their larger-than-expected BTC stash to cold-storage, as is proper.

🌎 El Salvador's massive #BTC move! They've shifted $400M to cold storage, flaunting a jaw-dropping 5,689.68 BTC hoard.

— Thomas Kralow (@TKralow) March 15, 2024

President Bukele is changing the game, doubling their stash & pushing global #Bitcoin adoption. Watch this space, the value's only going up! 💰 pic.twitter.com/yE6zwdYNXK

Not You

Anyone with two functioning brain cells knew this, but it's nice to see an official veredict. Craig Wright is not the author of the wite paper, nor Satoshi Nakamoto, nor the author of the initial versions of Bitcoin.

This is probably the first time this judge & his clerk have been hassled by a bunch of internet weirdos about the timing of a release of one of their judgments.

— Nathan C. Perry (@NathanCPerry) March 14, 2024

It seems pretty clear that’s why the judge made this statement from the bench.

It’s deeply under appreciated that… https://t.co/vgDZotNy5Q

NGMI

Dave Ramsey's criticisms on Bitcoin show he has absolutely not done the homework "Ask Warren Buffet" he says.

This is your only remaining edge in Bitcoin, other people's laziness and complacency. Will you take advantage of it?

Old people will never get it. Not everyone is going to make it to the life boats. That's OK, let them put their value where their mouth is. https://t.co/0fJscaDWww

— TK CTV OP_ATK (@ToxiKat27) March 14, 2024

Ramsey

Out of Pocket

Bitcoin fees are calculated based on the activity of the mempool —the temporary place where transactions "live" before they get added to a a new block.

But some of the JPG people have figured out they can bribe some pool managers by paying them directly instead of adding fees to the transaction the normal way. This is disruptive to fee calculation and has the added "benefit" of allowing a pool to pocket that income directly, without sharing it with the members of their pool.

I hope pools caught doing this get REKT

Something very dangerous is happening. This is slightly technical but the following is a very important thing for everyone that cares about Bitcoin to understand. I’ll keep it as simple as possible.

— Bob Burnett (@boomer_btc) March 14, 2024

Most mining pools use a payout method called FPPS. Hashers connected to that… https://t.co/5xsOYDDv89 pic.twitter.com/zhjB9gKsKc

Moronic

Speaking of mining, the Biden administration is thinking of taxing miners to the tune of 30% using false arguments. The upside of this is passing would be to decentralize mining further as miners flee the US en masse (like they did China).

The Biden administration is proposing a 30% excise tax on bitcoin miners’ electricity bills. They are claiming that bitcoin mining is bad for the environment, grid stability and electricity prices despite the fact that publicly available data proves otherwise.

— TFTC (@TFTC21) March 12, 2024

🤡🌎 https://t.co/swKD9aBUE3

Krypto News

"Crypto" can be lethal to your portfolio

Woof

It was a matter of time before Elon said something about Doge, triggering a promps pump-and-dump.

JUST IN: Elon Musk says Tesla will enable $DOGE payments "at some point, Dogecoin to the moon."

— Watcher.Guru (@WatcherGuru) March 14, 2024

pic.twitter.com/nZaLhXlvgL

Jeezus

Early BTC evanglist Roger Ver (aka "Bitcoin Jesus") is one of many examples of early adopters catching Bitcoin Derangement Syndrome. If you don't know who he is you should study his arc, a warning to us all.

Dedicated to the babies that died because of Bitcoin Core. pic.twitter.com/bX46FV7AFn

— Samson Mow (@Excellion) March 17, 2024

May I have Another?

Remember Dave "I-got-f*cked-so-hard-by-Bitcoin" Portnoy?

Did he commit to learning THE BASICS about Bitcoin?

Of course not, instead he invited the "Choose Rich" cringe-boi to his Podcast. Guy's a glutton for punishment.

I knew the moment I saw @allnick that I liked him and wanted to choose rich #DDTG pic.twitter.com/5MezrYj7qR

— Dave Portnoy (@stoolpresidente) March 12, 2024

One, Two…

Everyone in "krypto" is fawning on Solana because of its ample selection of ret*rded memecoins. Hell, even SBF is shilling it to his guards and prison mates. The FTX liquidators must be salivating at the upcoming rug.

Just a reminder that the FTX bankruptcy estate has 58 million Solana tokens to sell, which is over 13% of the total Solana supply, or about $8.5 billion dollars in today's prices. pic.twitter.com/7hezdasdxH

— Pledditor (@Pledditor) March 12, 2024

Not So Fast

Will an ETH ETF be approved? Maybe not.

The success of the BTC spot products clearly ruffling some feathers on the Hill. @SenatorJackReed and @Senlaphonza write to the @SECGov urging:

— Alexander Grieve (@AlexanderGrieve) March 14, 2024

-no further ETPs for other tokens

-make life difficult (i.e. examinations/reviews) for brokers and advisers that recommend BTC ETPs pic.twitter.com/enxdumC02N

Fiat News

Brrrr

The US unveiled its new 7.3 Trillion budget

The White House unveiled a $7.3 trillion fiscal budget for the 2025 fiscal year, lasting from October 1st, 2024 to September 30th, 2025. In the document, he details massive spending toward services, tax breaks, credits for the middle class, and a slew of additional spending… pic.twitter.com/eDVcGBDoEO

— Joe Consorti ⚡ (@JoeConsorti) March 11, 2024

Reminder: a Trillion used to be a lot of money.

This is the scariest chart I’ve ever made. This is what it looks like when a country is heading toward a financial precipice.

— Robert Sterling (@RobertMSterling) March 11, 2024

Each color shows $1T getting added to the national debt.

Not that long ago, it took six years to add a bar.

We’re now adding one every 90-120 days.… pic.twitter.com/RZ1B8vrZqW

And if you're wondering who will buy all that debt? —considering appetite for US Treasuries seems to be muted— The Fed has an answer for you "Maybe banks if we tweak the rules a little"

Banks have dumped $152 billion of US government debt this year.

— Joe Consorti ⚡ (@JoeConsorti) March 11, 2024

The US Treasury isn't too happy about that, and a potential rule change is in the cards to force banks to buy in perpetuity.

With $7.3 trillion in spending planned for next year, somebody's got to fund it. https://t.co/D7Wgbp9Kep pic.twitter.com/9RBQgh1I2g

IF US Treasuries are excluded from bank leverage calculations this would essentially allow banks to print money out of thin air to buy Treasuries (with no discenible limit).

This would be a perfect example of "Not QE, but QE". The Fed has many ways to make the printer go Brrrr

Dystopian News

Tiktak

Much as I despise TikTok, this is not the way. With election season coming, this will lead to attempts to ban other platforms, bet.

The so-called TikTok ban is the government’s latest effort to control speech and control you. The bill’s definitions give it broad potential application. As with the Patriot Act, FISA, and AUMFs, the executive branch will maximally exploit each provision to amass and abuse power.

— Justin Amash (@justinamash) March 13, 2024

Boeing

The speed at which Boeing mishap / accident reports have been piling up seems almost farcical, but things took a dark turn when a whistleblower who was testifying against them turned up dead, allegedly a suicide but the facts don't seem to add up.

NEW: 62-year-old Boeing whistleblower John Barnett found dead in his truck after he didn't show up for a legal interview linked to a case against Boeing.

— Collin Rugg (@CollinRugg) March 11, 2024

Barnett worked for Boeing for 32 years and retired in 2017. After retiring, Barnett spoke out about how Boeing was cutting… pic.twitter.com/k3zOqH0REv

The market isn't buying the suicide story either.

The market does NOT like Boeing assassinating its whistleblowers

— Mohammad (@Abu9ala7) March 12, 2024

Personally, I thought it was bullish pic.twitter.com/YtdNW8M5ua

Be Scanned

Digital IDs will be pushed hard in the near future and you can be sure they will be hard to resist —for example some countries already scan your retinas and fingerprints in order to issue a passport. This will greatly expand governments' abilitiy to monitor, surveil and control its citizens and their movements.

This is a glimpse of what the future will be like with digital I.D

— Wall Street Silver (@WallStreetSilv) March 17, 2024

These police officers are scanning people's faces to see if they are wanted.

The government will be involved in every aspect of your life.

This is not good.

🚨🚨🚨 pic.twitter.com/Ddhu7gf5Ve

If coupled with a CBDC —which the Fed has denied being interested in— you'd have the ingredients for a dystopian big brother state.

The Fed's claims that it's uninterested in CBDCs are likely just theater, aimed at not producing friction until absolutely necessary.

If you don’t think the Fed is pursuing a CBDC, think again.

— Tom Emmer (@GOPMajorityWhip) March 14, 2024

The Fed gave this to my staff during a presentation earlier this Congress. They view a CBDC as one of their KEY DUTIES. pic.twitter.com/0LcdWBKk58

Keep'm Coming

If you are concerned your tax dollars are not being put to good use in Ukraine you can set those fears aside, you're funding the best people money can buy.

So that's where my tax paying dollars are going ... 🤡 🌎

— Wall Street Silver (@WallStreetSilv) March 17, 2024

Be sure to pay all of your taxes due by April 15th, Ukraine needs the money. pic.twitter.com/4GiQ8uPidv

Price News

Was the recent dump related to MSTR?

Need to open by suggesting you don't try to find a "why" behind each dump. Someone always comes up with a reason but only rarely are the narratives true. Back to speculating…

Last week someone mentioned MSTR was being massively shorted.

MSTR has 21.5% of its shares sold short. Imagine the pain being felt by MSTR shorts right now.

— Vijay Boyapati 🦢 (@real_vijay) March 14, 2024

This could turn into GameStop on steroids 😳 pic.twitter.com/RbzeCBux66

And apparently one of the funds involved, ahem, got its shorts blown, forcing to liquidate a ton of BTC, depressing price.

So some giga brains decided to open a pair trade: long BTC, short MSTR

— Satch is stacking sats (@21satch) March 17, 2024

MSTR spiked, their short blew up, and they were forced to sell their BTC to cover

Now saylor gets to buy lower on Monday with a fresh $600m thanks to this entity that may go bust😂🤝 pic.twitter.com/lEK10HSGrR

Here's some actual liquidation data. On Mar 4 we had one giant 800MM Liquidation. On Mar 14, 15 and 16 (today) we have crossed 1 Billion.

— Fred Krueger (@dotkrueger) March 16, 2024

This is forced selling. It happens fast. It pushes down prices agressively, especially if there is no buying pressure to match (Friday was… pic.twitter.com/7XlT6r0pvP

Bitcoin Surfing

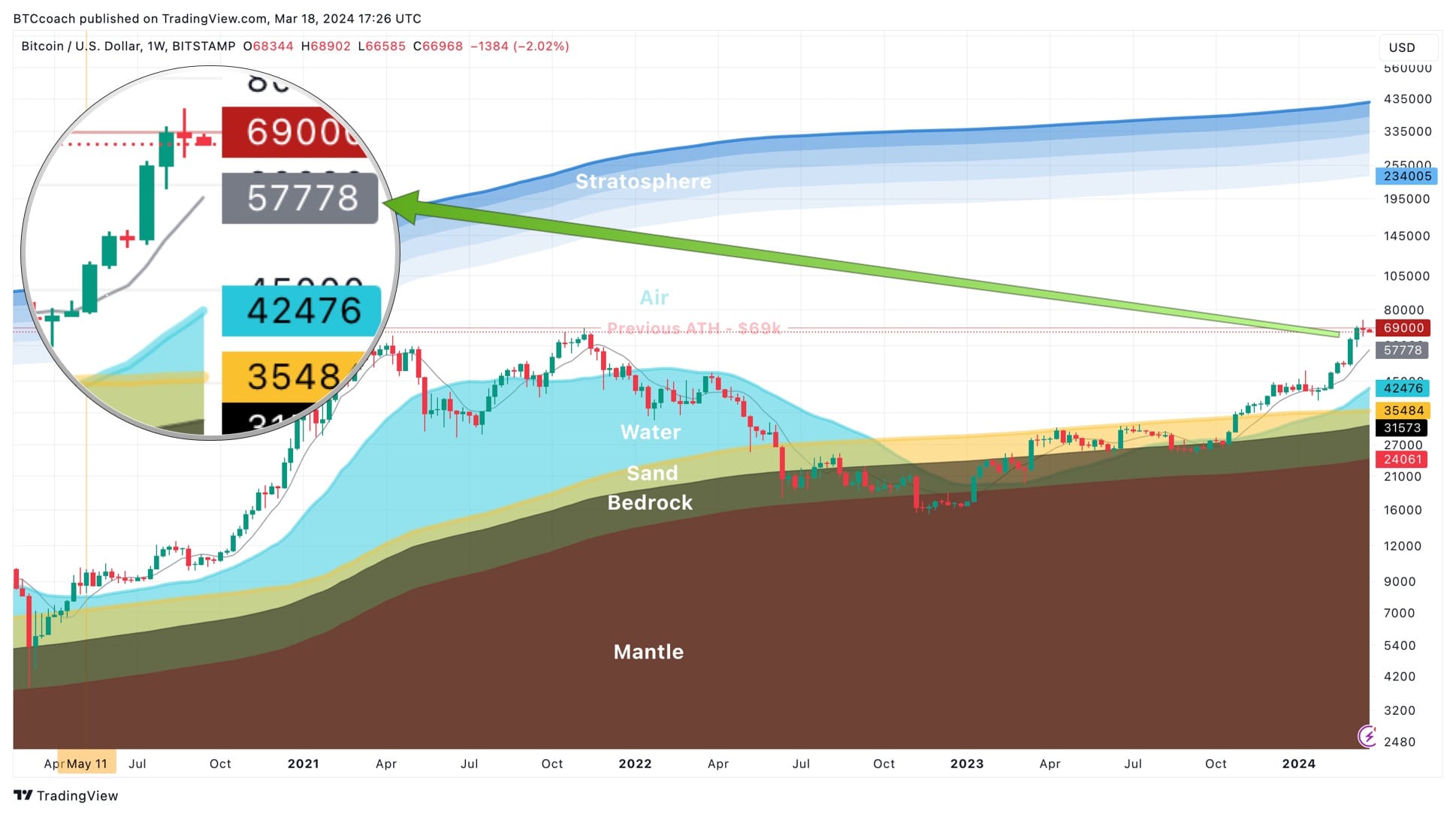

BTC took a little breather last week, coming back down below $69k after smashing through this previous ATH. The Board ($57.7k) keeps climbing to catch up.

Dip Fishing

After breaking through the previous ATH and climbing up to $73k, price plunged back into the $65k support and bounced back. Currently flirting with $69k again.

Calm Chart

Despite the commotion last week, March remains comfortably green.