2023.46 - Soft Landing

IMHO

The Soft Landing narrative is being shoved down our throats.

Soft Landing:

refers to the Federal Reserve's goal of achieving a slowdown in economic growth without causing a recession. This means the central bank wants to avoid any sudden or sharp declines in employment, inflation, and other key economic indicators while still managing to cool down an overheating economy. —Hermes AI

Quick search for "soft landing" stories on Bloomberg Terminal this am, here's the first page. pic.twitter.com/fqfIBo1sIV

— James Lavish (@jameslavish) November 15, 2023

OK, so let's look at some of the key indicator used to measure whether or not the mythical "soft landing" is being achieved:

Inflation: CPI print fell to 3.2% in October (beating expectations of 3.3%). How do we square this with rising prices across so many sectors?

While CPI inflation is at 3.2%, inflation is much higher in many basic necessities:

— The Kobeissi Letter (@KobeissiLetter) November 17, 2023

1. Car Insurance Inflation: 19.2%

2. Car Repair Inflation: 9.6%

3. Transportation Inflation: 9.2%

4. Rent Inflation: 7.2%

5. Homeowner Inflation: 6.8%

6. Food Away From Home Inflation: 5.4%

7.…

Easy peasy, just change the way CPI is calculated.

In this particular case they changed the way they calculate the health insurance portion of the CPI, causing it to "drop" 34% (they are now measuring insurance company profits instead of customer paid premiums).

Very real data that caused the CPI beat today pic.twitter.com/i9OrV49soW

— Swordfishvegetable (@Swordfishv44183) November 15, 2023

Unemployment: Looks like the much awaited "softening of the labor market" is finally happening.

This is one of the more interesting data points I’ve seen recently. When long-term unemployment rises by 15% year over year we are either in a recession or nearing recession 100% of the time.

— Cullen Roche (@cullenroche) November 6, 2023

Is it different this time? If you think so, why? pic.twitter.com/Qfr8naCe7J

But was the labor market really all that strong to begin with? Mr. Anderson calls BS explaining that part-time jobs and second jobs constituted a significant amount of the "job growth"

The jobs report is a complete scam...

— Mr. Anderson (@TrueCrypto28) October 6, 2023

Here's what the headline number did not tell you...

Full-time employment is down an unbelievable -692k over just the last 3 months.

We have only seen these kinds of numbers before massive recessions. I'm not calling for that b/c our Gov't…

Any way you slice it, seems layoffs are coming soon to a business near you

BREAKING: Chrysler offers voluntary separation packages for 1/2 of U.S. white-collar employees to reduce headcount

— Financelot (@FinanceLancelot) November 13, 2023

The packages will be offered to 6,400 of its 12,700 U.S. employees with five or more years of employment, the company said Monday 🤪

HT to @driven_onward https://t.co/huy4E6LOWb pic.twitter.com/hzIMZJOR5p

Recession? What recession?

— Wall Street Silver (@WallStreetSilv) November 18, 2023

10,000+ layoffs coming.

More banks to follow? pic.twitter.com/jTtJW8oyvh

Financial Market Stability: Well, the stock market is dong pretty well, especially if by "stock market" you mean 7 top tech stocks and you ignore M2 expansion (see Fiat News).

Technology stocks just hit all-time highs relative to the S&P 500, according to Bank of America.

— The Kobeissi Letter (@KobeissiLetter) November 14, 2023

The tech to S&P 500 ratio is now 15% higher than the 2000 peak.

This ratio is also 20% higher than the 1960s bull market peak.

However, tech stocks and tech companies are certainly… pic.twitter.com/5L4x8lkfU4

And don't get me wrong, I love tech, and am all for it. But these valuations are insane. Nvidia —who just lost $5B to a chip embargo— added the equivalent of 7 years of earnings in 10 days, mind you it was already 178% up this year (560% up since Jan 2020) before this happened.

In 10 trading days, $NVDA has added $280,000,000,000 in market cap.

— Expound the profound - Current Thing Expert™ (@frankoz95967943) November 14, 2023

To put that into perspective, this company makes about 10B per quarter.

They added 7 years of earnings in 10 days.

I'm not saying it can't go higher, nor am I saying I'd short it. I'm just pointing out this is not a serious market.

We could keep going and look at consumer spending, the housing market, credit conditions or some of the other parameters by which a "soft landing" is evaluated. At the end of the day, the numbers will be massaged constantly to support the narrative at least until the election. They may get their "soft landing" but the thing that lands will be a pissed off Dragon of Debt.

Billionaire Ray Dalio chimes in:

We are at a point where we are borrowing money to pay debt service… that means you have debt service encroaching on your spending… if you want to keep spending at that level there is a need to get more and more into debt… and the way that works is it accelerates —Ray Dalio

RAY DALIO: The 🇺🇸 US is at an inflection point concerning its national debt as it currently borrows money to cover its debt payments 👀😱 pic.twitter.com/gWEyc0gtqL

— Bitcoin News (@BitcoinNewsCom) November 17, 2023

In addition to a huge existing debt —over $8 trillion of which will need to be re-financed at higher rates within a year —there is a growing deficit which seems to have no breaks.

An unprecedented $8.2T of US government debt will be maturing in the next 12 months, or 1/3 of the total Treasuries outstanding.

— Otavio (Tavi) Costa (@TaviCosta) November 14, 2023

That is 3.5x more than what was net issued so far this year.

Keep in mind that the fiscal deficit next year would also require at least another $2T… pic.twitter.com/VD7pp11Eyu

Bottom line is, the US can't afford positive real rates, which would be worrisome under any circumstance, but is especially bad at a moment when foreign governments —usually big buyers of US Debt— are buying much less of it (Dalio also mentions this).

One of the most important macro developments in the past 50 years (global Central Banks stopping sterilizing US deficits [a.k.a. growing UST holdings] in 2014) becoming more mainstream by the month it seems... pic.twitter.com/5opNhLF15e

— Luke Gromen (@LukeGromen) November 17, 2023

It's good to be clear for some foreign nations , it's not a matter of whether they WANT to buy Treasuries, they NEED to sell USD denominated assets (including Treasuries) to defend their own currencies against the "Dollar wrecking ball".

BREAKING 🚨: Japanese Yen

— Barchart (@Barchart) November 14, 2023

Japanese Yen closed at its lowest level against the U.S. Dollar in more than 33 years pic.twitter.com/9TlFK9ALJv

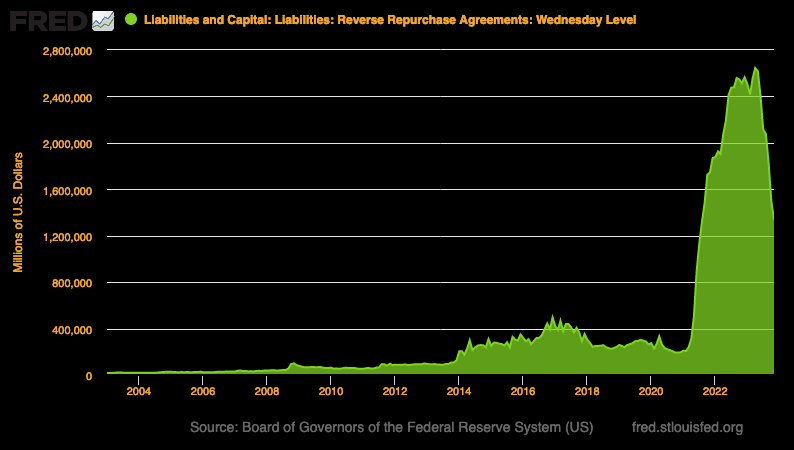

There's another buyer who'll be running out of steam soon. The funds in the Reverse Repo facility are being drained rapidly (down $1.3 Trillion since its peak 7 months ago)

So, who's going to buy all the debt the US will need to issue (and at what price?)

Excellent questions on which much of the global economy may hang.

The situation is not the current administration's fault —incompetent as though they may be. This is a problem that's been brewing for a very long time, but their insistence on pushing a "soft-landing" narrative is politics at its worst.

Those who buy the story will be caught off-guard when the economy turns. Don't be one of those people, protect your savings in hard assets.

Bitcoin News

El Presidente

Javier Milei is the new President of Argentina. I'm old enough not to pin my hopes on any politician and I am not well versed on Milei's stance on all things. But I understand he is for property rights and liberty. Many (including the market, which pumped on the news) think he's good for Bitcoin. I don't know about that.

I do know he understands Bitcoin better than most and that Argentina's money and economy are beyond broken, so I'll say this: he makes me hopeful.

"Viva la libertad carajo!"

Javier Milei: “Today the reconstruction of Argentina begins.”🇦🇷🧡

— Cory Bates (@corybates1895) November 20, 2023

pic.twitter.com/yjLsuqBiVW

Pavol Luptak did a good job of capturing my sentiments towards Milei:

From the center of Buenos Aires, I warmly congratulate all Argentines on the result of their democratic elections (although I am not a fan).

— Pavol Lupták (@wilderko) November 20, 2023

The voter turnout here was really high (76%).

Before you start reading the European media's bullshit about Milei being an… pic.twitter.com/f2c4AcjGdD

Sober Lightning

David Marcus (ex. Meta / Paypal) give a bullish but sober assesment of Bitcoin and Lightning:

- Bitcoin is the only viable neutral settlement asset / network

- Lighning is necessary to make it faster

- Lightning works well for enterprises

- Non custodial / sovereign use of Lightning still needs improvement

- Stablecoins / other assets on Lightning will be critical

Lately, there's been more debate around the value of the #Bitcoin Lightning Network. Based on the work we've been doing @Lightspark for the past 18 months, I will share my honest view.

— David Marcus (@davidmarcus) November 19, 2023

First things first — Bitcoin is the only viable neutral settlement asset and network that can…

Thainance

Binance to open a new exchange in Thailand

NEW: 🇹🇭 Binance to launch new #Bitcoin and crypto exchange in Thailand with country's 2nd richest man pic.twitter.com/CrGFObEp6t

— Bitcoin Magazine (@BitcoinMagazine) November 16, 2023

Commerz

Custodial services from banks will be commonplace in the future. This is not bad per se, but history clearly shows you should custody your own coins

ICYMI: Germany's fourth largest bank, @commerzbank, leads the way as the first full-service bank in the country to secure a #Bitcoin and Crypto Custody License 🇩🇪#BTC https://t.co/EhRsB4SXNF

— BTC Times (@btc) November 18, 2023

Bruv

This is embarassing. Brad Mills —a well known Bitcoin Maxi with over 65k followers— is not up to speed on the basics of Lightning. This wouldn't necessarily be a bad thing …if he wasn't an outspoken Lightning advocate.

One of the biggest supporters of Lightning

— Erica Wall (@ercwl) November 18, 2023

Who went on Real Vision as the face of Bitcoin Maximalism

Who sits on the cap table of *dozens* of Lightning startups

Who camps in Spaces and consistently calls Ethereum an overengineered scam

Learned TODAY how payment channels work pic.twitter.com/3VRISiMDAf

Long As They Pay…

I've said it since the beginning. As long as the Ordinals / Inscriptions (NFT) crowd pay for their shennanigans, I don't have a major issue with them.

Inserting what is essentially noise into the Bitcoin blockchain should be this costly. I'm ok with a few LN FUD tweets if dimwits are bankrupting themselves fighting Bitcoin's anti-DoS measures. https://t.co/jGQWxv05ef

— notgrubles (@notgrubles) November 19, 2023

#Bitcoin miners have been paid more in transaction fees today than Ethereum's validators.

— Satoshi (@satoshimoneybtc) November 17, 2023

Keep in mind, this doesn't include Bitcoin's block rewards of 900 BTC today ($32,769,000)

Who still thinks #Bitcoin will have a security budget problem when the block reward goes away in… pic.twitter.com/UkiSoFIcWB

Derivative Work

I'm not particularly a fan of derivatives or leverage. My experience is they're a perfect combination to get REKT. But CBOE will be offering them starting January next year.

BREAKING: CBOE will launch margined Bitcoin and Ether futures on January 11th, 2024.

— The Kobeissi Letter (@KobeissiLetter) November 13, 2023

This will make CBOE the first US regulated crypto exchange with spot and leveraged derivatives trading on a single platform.

Plans to expand beyond Bitcoin and Ether at a later date are… pic.twitter.com/nfybKQAqQf

"Crypto" News

The jokes often write themselves

Not Sending Their Best

Look, many of us have fallen for one crypto narrative or another along our journey, but becoming an active Hexican is a hard one to come back from.

if you want to understand how retarded the federal reserve really is, they brought in an ex-federal reserve guy to be a critic in the richard heart documentary and after learning about it he became a hexican and teaches hex to his students in classrooms now pic.twitter.com/Qhdzhd9ERT

— Erica Wall (@ercwl) November 17, 2023

Ish

Chainalysis is supposed to be the firm that destroys the anonymity in Crypto (for your safety of course). But apparently sometimes they just guess.

this is beautiful. chainalysis' head of sanctions strategy essentially disavows all their recent publications on terror financing, going so far as to call their 450k number "an example" https://t.co/G2mNe6itIW

— Data Finnovation (@DataFinnovation) November 15, 2023

Clearing Rubble

Some of the major parties entwined in the latest crypto meltdown are finally starting to move forward

Bankrupt cryptocurrency lender Genesis has reached a $33 million settlement with former crypto hedge fund Three Arrows Capital to resolve $1 billion in claims relating to transfers made before the former’s bankruptcy in January. —Elizabeth Franklin

Bankrupt crypto lender Genesis, owned by @DCGco, has reached a settlement with collapsed hedge fund Three Arrows Capital to settle $1 billion in claims. @BrandyBetz reports https://t.co/BNylEiFz4u

— Laura Shin (@laurashin) November 13, 2023

TETHER

Few words in this space are as polarizing as "Tether". Austin Campbell makes a couple of good points about them:

- Their lack of US nexus is a feature, not a bug (they're part of the "Eurodollar" market)

- It's massively profitable

- If it were unbacked, someone would have already broken their peg through arbitrage

More of people misunderstanding the market. This strikes me as peak navel-gazing US exceptionalism and abject denial of reality. Here is the truth, with apologies to all the Tether truthers that have been losing many many millions of dollars shorting an “obvious” fraud:

— Austin Campbell (@CampbellJAustin) November 15, 2023

1 -… https://t.co/4HQik4OYdM

So Close

Should've just bought some Bitcoin.

JUST IN: World’s third-largest pension fund, South Korea’s National Pension Service purchases $19.9 million worth of Coinbase shares.

— Watcher.Guru (@WatcherGuru) November 16, 2023

JUST IN: 🇨🇳 China's largest board and card game company, Boyaa, to acquire $90 million worth of #Bitcoin and Ethereum.

— Watcher.Guru (@WatcherGuru) November 14, 2023

Fiat News

Not Impressed

If you adjust the stock market returns by taking out monetary (M2) expansion, you might find yourself in the red.

**Update To Thread**

— Preston Pysh (@PrestonPysh) November 16, 2023

Here are all the major global stock markets (in USD terms) combined into a single chart & weighted for their relative size. The second chart is the same thing but normalized for the growth in the M2 currency supply. pic.twitter.com/klq8VxmTzr

Mirror

This is a good barometer for gaging the extent to which most investment advisors understand what's going on. I understand they haven't wrapped their head around Bitcoin, but they should at least be allocating SOME percentage to gold.

The fact they are not suggests they're basing their portfolio on the experience of the last 40 or so years and not paying a lot of attention to the ways in which the foundations of the system have been deteriorating. They are in for a nasty surprise.

This is an important day to highlight the following:

— Otavio (Tavi) Costa (@TaviCosta) November 16, 2023

71% of investment advisors hold 0-1% of gold in their portfolios today.

I cannot recall a time in history when the metal was as underallocated as it is currently.

Additionally:

Keep in mind that in 1980, gold constituted… pic.twitter.com/3D7We7EvRZ

Dystopian News

Exits Barred

Make sure you have a hardware wallet on hand before your country decides to ban them, like Vietnam did.

Had my Coldcard refused entry in Vietnam. Customs require a license to import HWWs.

— Mind & Reason (@The_BTC_Base) November 19, 2023

Since @Coinkite won’t accept returns, they should update their shipping info into 🇻🇳, warning people a govt license is needed or shipment will be rejected.

OK Nimrata

Nimrata Nikki Randhawa, who plays a politician called "Nikki Haley" on TV, says you can't use fake names on social media because National Security. LMAO.

Nikki Haley: everyone on social media should be verified. Anonymous accounts are a national security threat. Scary and short sighted.

— Gabor Gurbacs (@gaborgurbacs) November 14, 2023

The Federalist Papers were published anonymously, under the pen name “Publius”.

Satoshi was also anonymous for a reason.pic.twitter.com/PwCCdpSttv

WHO DaF*k?

There is discussion to give The World Health Organization (WHO) —an unelected supranational entity— broad powers through a Pandemic Treaty which give them the right to declare a public health emergency and morph from a guiding force into an authoritarian ruler —including the power to remove Freedom of Speech and Human Rights protections— and allowing them to mandate surveillance and vaccinations. All to combat "public health threats" and to prevent climate change of course.

"We're undergoing a soft coup... under the pretext of pandemic preparedness and the biosecurity agenda."

— Wide Awake Media (@wideawake_media) November 12, 2023

Dr. Meryl Nass explains how the WHO's proposed pandemic treaty will enable the WHO "to take over jurisdiction of everything in the world by saying that climate change,… pic.twitter.com/eV31KhZSRQ

I strongly recommend you take a few minutes to peruse this thread, which spells out some of the proposed changes.

Mega Thread 🧵 pic.twitter.com/R0IlqIbLxr

— Champagne Joshi (@JoshWalkos) November 15, 2023

Criminalizing Curious Giorgio

IN Italy you could be jailed for searching the wrong words in your computer.

Read that again.

Italian government is passing a law to make the simple searches online jail-worth felonies. For my international friends that had high hopes for Meloni's government as something different from the same old Orwellian Maoism, just because of a few based quotes: I told you so. https://t.co/tvqjXMoFPc

— Giacomo 80 IQ HODL Zucco⚡️🌋🧀💀 (@giacomozucco) November 16, 2023

A few Trilli

The Pentagon still has no clue where $3.8 Trillion went. It's hard to imagine just how big one Trillion is, let alone almost 4

JUST IN - Pentagon has again failed its independent annual audit of $3.8 trillion in military assets — Stripes

— Disclose.tv (@disclosetv) November 16, 2023

Here's an image for context, mow multiply by four:

Amateurs

One of the biggest business sagas in my lifetime played out over the weekend.

In what many have described as a coup, OpenAI's board surprise-fired founder Sam Altman for vague (as far as the public could see) motives.

This end-of-day news caused Microsoft —who had pledged but not transferred $80 Billion to Open AI— to shed a few Billion in market cap, rightfully infuriating its CEO. Rumors flew all weekend and it seemed the Board would resign and bring Sam back…

Instead Sam was hired by Microsoft and over 650 (out of 700) OpenAI employees might follow along. Open AI is basically done. Impressive really.

Microsoft just pulled off one of the greatest "acquisitions" of all time:

— The Kobeissi Letter (@KobeissiLetter) November 20, 2023

Prior to the firing of Sam Altman, OpenAI was worth ~$90 billion.

This weekend, Microsoft was able to hire Sam Altman and Greg Brockman after having no advance notice that they would be fired.

Then, as…

Here's a quick blow-by-blow

OpenAI saga in 90 seconds:

— Alex Lieberman (@businessbarista) November 20, 2023

- Thursday night, Sam Altman gets a text from Ilya Sutskever, OpenAI’s chief scientist & board member asking to chat on Friday.

- Friday at Noon, Sam Altman is fired by the Open AI board because he was “not consistently candid in his communications.”… pic.twitter.com/om8HJMpb1Y

WIN

The EU Parliament has voted against CHAT CONTROL, a warantless mass surveillance proposal that would have allowed the EU to scan messages, including encrypted ones. "for possible criminal content".

Price News

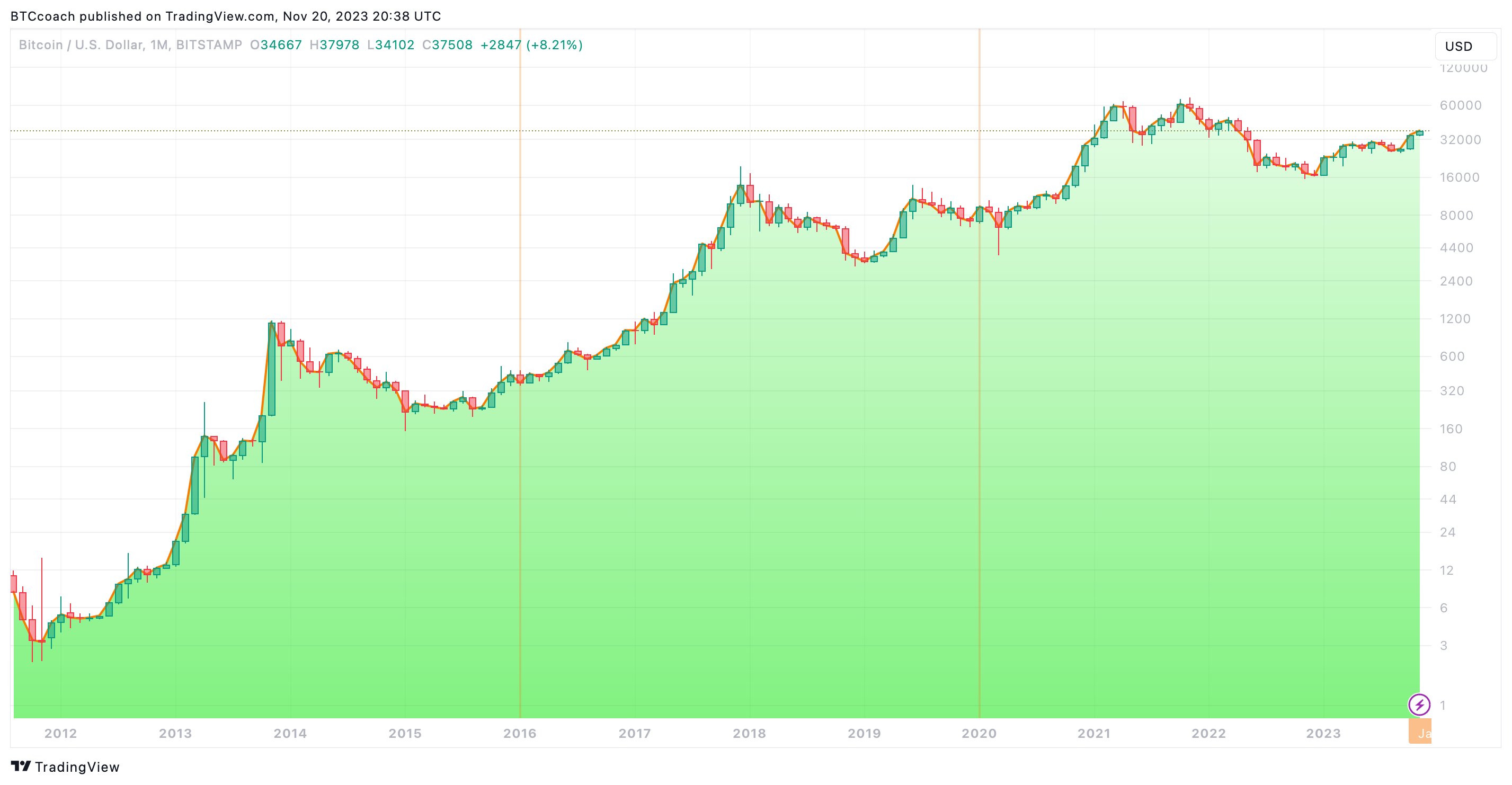

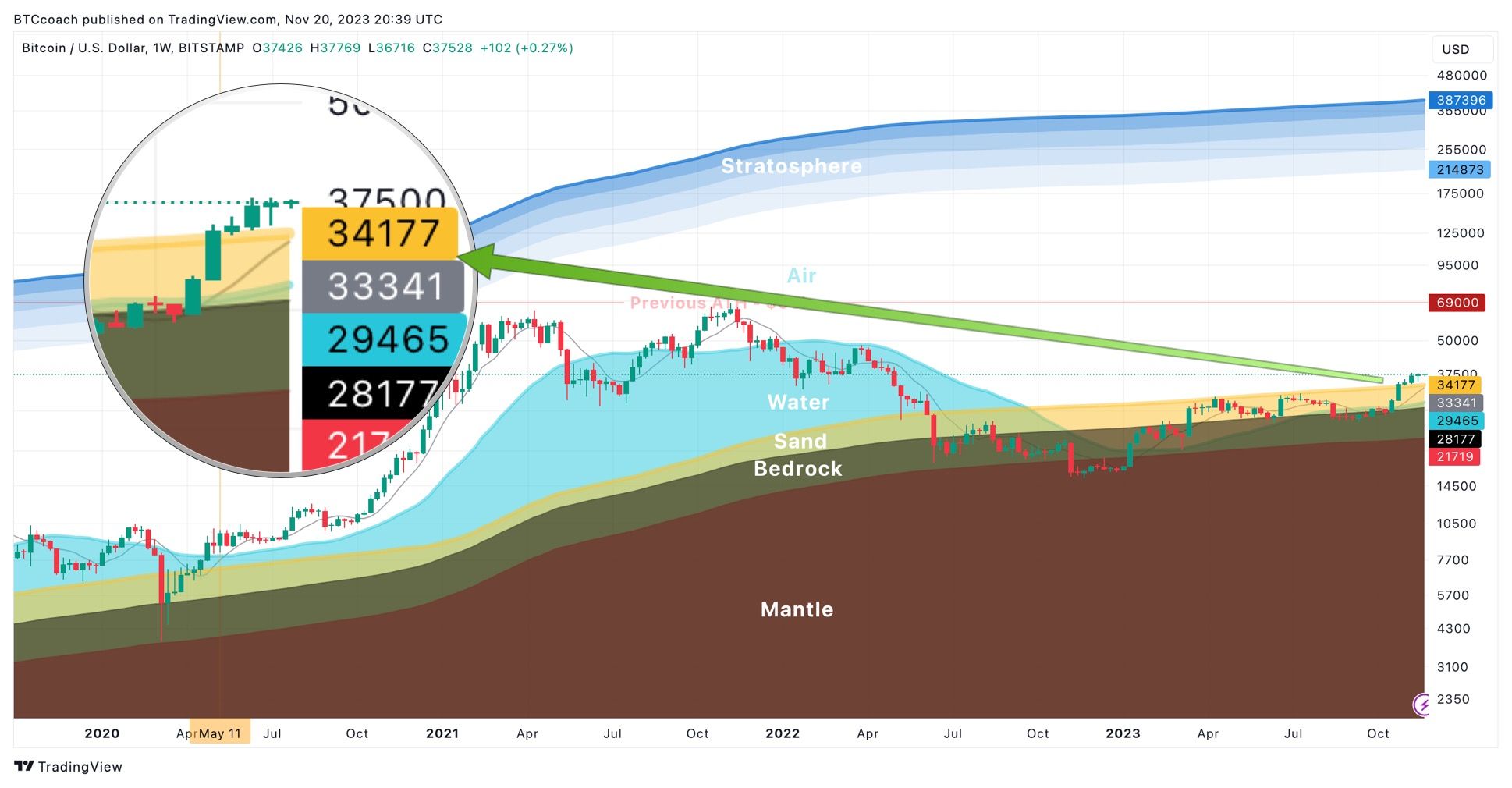

Bitcoin Surfing

Bitcoin jumped for joy with Melei's election to Argentina's presidency. Seems it may be shaking off its sea legs.

Dip Fishing

Melei's triumph pushed Bitcoin above the $37k mark. The previous week saw it bounce between the full range between $38k resistance and of $35k support (still in play).

Calm Chart

November looks like it will close green.